We may not have the course you’re looking for. If you enquire or give us a call on 44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Do you love diving into numbers and exploring financial information? Then, the world of Financial Modelling could be your ideal playground! Financial Modellers are the rockstars of the Financial Modelling Jobs scene. Picture yourself as the go-to person who crafts intricate Financial Models, predicts future earnings, and sizes up potential investments.

Your skills could be the compass that steers businesses towards smart choices and peak financial health. Check out this blog on Financial Modelling Jobs to discover if you’ve got the knack for crunching numbers and shaping the future of finance!

Table of Contents

1) Financial Modelling Analyst Job Profile

2) Responsibilities of Financial Modelling Jobs

3) Essential Skills for Financial Modelling Jobs

4) Techniques to Optimise Your Job Description

5) Financial Modelling Analyst Job Description Template

6) Salary Insights for Financial Modelling Positions

7) Conclusion

Financial Modelling Analyst Job Profile

Financial Modelling is a representation in numbers of an organisation's operations in the past, present, and forecasted future. These models are used as a decision-making tool. The executives in the company can use them to evaluate the costs and project the profits of a proposed new project.

Financial Modelling Analyst works in equity research, investment banking, corporate development, private equity, corporate finance, and so on. Here, they perform analysis of financial data and transactions. They also establish links between the financial statements, prepare presentations, perform sensitivity analysis, etc.

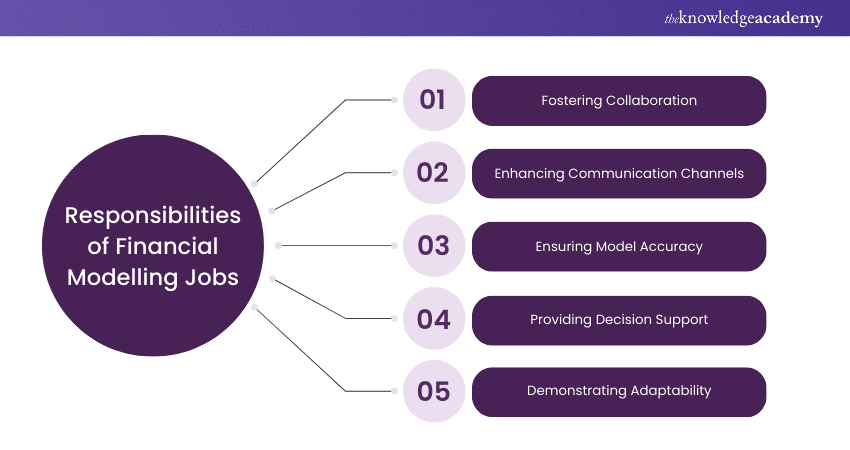

Responsibilities of Financial Modelling Jobs

Financial Analysts have several responsibilities as part of their job. Some of them are mentioned below.

1) Fostering Collaboration

Financial Analysts should work closely with cross-functional teams. They provide financial insights to guide strategic decisions.

2) Enhancing Communication Channels

They should present findings and recommendations clearly and concisely in front of financial and non-financial stakeholders.

3) Ensuring Model Accuracy

They should ensure that the Financial Models are accurate, error-free, and reflect the operational complexities of the business.

4) Providing Decision Support

Financial Analysts should assist management in making informed choices by providing accurate financial insights.

5) Demonstrating Adaptability

They should modify models to accommodate changing business circumstances, regulatory changes, or new data.

Transform your financial skills: Join our cutting-edge Accounting and Finance Training!

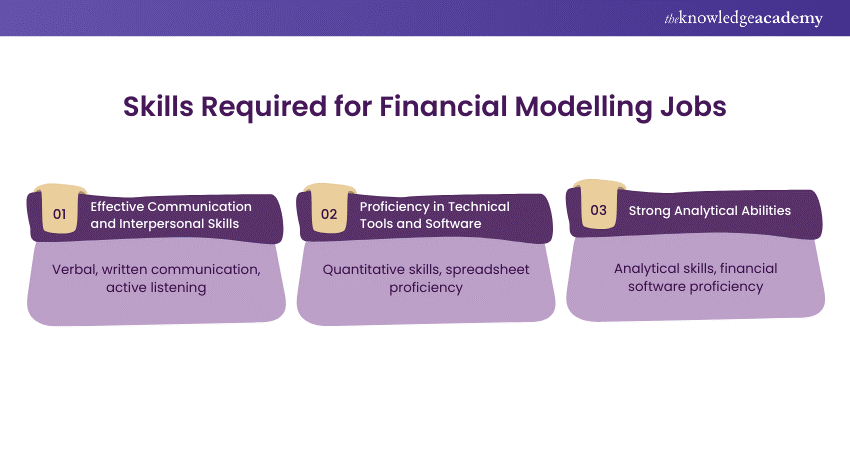

Essential Skills for Financial Modelling Jobs

Financial Modelling is an important skill set for professionals in the finance and investment field. Here are some skills required for these professionals:

1) Effective Communication and Interpersonal Skills

Financial Analysts should focus on verbal and written communication, active listening, nonverbal cues, presentation, negotiation, and networking skills. It will help them effectively convey information and ideas, build trust with clients and colleagues, and make informed decisions.

2) Proficiency in Technical Tools and Software

Financial Modellers typically need a highly quantitative background. They should be proficient in technical abilities and have a deep knowledge of the analytic and spreadsheet software used to create Financial Models.

3) Strong Analytical Abilities

Strong analytical and problem-solving skills with attention to detail. Experience in Financial Modelling, forecasting, and data analysis. Proficiency in financial software, including Excel, Bloomberg, and other data management tools.

Step Into financial mastery: Join our premier Financial Management Course now!

Techniques to Optimise Your Job Description

If you are looking for some tricks and techniques to improve your profile visibility, continue reading to learn them. These strategies would help you effectively in your job hunting:

1) Detailed and Optimised Profile: Fill out your profile with the correct information and add a professional photo.

2) Keyword Optimisation: Optimise your resume using relevant keywords including Financial Modelling, business valuation, equity research, etc.

3) Follow Companies and Network Broadly: You should stay updated with the employers of your preferred company. You can also stay connected with colleagues, peers, and influencers in this industry.

4) Publish Content: Try sharing articles and insights to showcase your expertise.

5) Stay Active and Engage with Content: You should log in regularly on the platforms like LinkedIn to show your engagement. You can like, comment, and share relevant posts to stay visible.

6) Job Alerts: Set up job alerts to receive relevant openings.

7) Apply Promptly: Apply to jobs as soon as possible after posting.

8) Upload Resume: Ensure your resume is searchable for recruiters.

9) Customise Applications: Customise your resume and cover letter for each job.

10) Stay Updated: Regularly update your status and experiences.

Financial Modelling Analyst Job Description Template

Now, lets' take a look at few Financial Modelling Analyst Job Description Templates

Template 1

|

Job Title: Financial Modelling Analyst Location: [City, State] or Remote Job Description: Financial Modelling Analyst at [Company Name] help in generating, improving and updating analysed models used for strategic planning and management purposes at the company. You will interpret and evaluate financial information, predict future performance and present recommendations on the basis where and how to invest and mix resources. Some of the responsibilities towards the task will include cooperation with various departments like Corporate Finance, Strategy and Business Development to coordinate the Financial Models with the general strategic goals of the organisation. Responsibilities: a) Create complex financial plans to assist in major business planning, internal investment, and strategic targets. b) Analyse the financial information using Industry performance, company performance, and financial performance of key ratios. c) Develop future financial performance projections derived from different working scenarios whereby the forecast considerations include the revenue, expenses, and cash flow. d) Conduct effective oral and/or written presentations to decision makers, whilst presenting comprehensive analytical findings and potential solutions. e) Analyse possible investment opportunities and evaluate their desirability for mergers and acquisitions by employment of models for profitability and risk. f) Perform sensitivity analysis to provide insights on potential risks and opportunities. g) Collaborate with other departments to gather information and align Financial Models with overall business objectives. h) Regularly update and refine Financial Models to reflect changes in business operations and market conditions. i) Ensure the accuracy and integrity of Financial Models through thorough reviews and validation processes. Requirements: a) A degree in Finance, Economics, Accounting, Business, or a related field. b) Proven experience as a Financial Modelling Analyst or in a similar role. c) Strong understanding of Financial Modelling techniques and tools. d) Proficiency in Microsoft Excel and Financial Modelling software. e) Excellent analytical and problem-solving skills. f) Strong communication skills and the ability to present complex financial information clearly. g) Ability to work in a team environment. h) Attention to detail and commitment to accuracy. |

Template 2

|

Job Title: Senior Financial Modelling Analyst Location: [City, State] or Remote Job Description: You will be expected to work as a Senior Financial Modelling Analyst at [Company Name] where your responsibility will be to create complex Financial Models, which will guide the strategic direction of the company. Some of the duties include data analysis, preparing estimated performance reports, and making recommendations to the top management. Your experience will be beneficial in determining our investment solutions and business approaches. You will also guide Junior Analysts and collaborate with other departments to guarantee that the established Financial Models are solid and effective. Responsibilities: a) Lead the development and refinement of complex Financial Models to support strategic decision-making and business planning. b) Conduct in-depth analysis of financial data, including historical performance, trends, and financial ratios. c) Forecast future financial performance under various scenarios, including revenue, expenses, and cash flow. d) Prepare detailed reports and present them to senior management, highlighting key insights and recommendations. e) Evaluate investment opportunities, mergers, and acquisitions by building and assessing Financial Models to determine profitability and risk. f) Perform sensitivity analysis to find potential risks and opportunities, providing strategic insights to Senior Management. g) Integrate financial statements, including income statements, balance sheets, and cash flow statements, into comprehensive Financial Models. h) Collaborate with corporate finance, strategy, and business development teams to gather information and align Financial Models with business objectives. i) Regularly update and maintain Financial Models to reflect changes in business operations and market conditions. j) Mentor Junior Analysts, providing guidance and support in Financial Modelling techniques and best practices. k) Ensure the accuracy and integrity of Financial Models through rigorous reviews and validation processes. Requirements: a) A degree in Finance, Economics, Accounting, Business, or a related field. b) Extensive experience as a Financial Modelling Analyst or in a similar role. c) Advanced understanding of Financial Modelling techniques and tools. d) Proficiency in Microsoft Excel, Financial Modelling software, and data analysis tools. e) Strong analytical and problem-solving skills. f) Good communication and presentation skills are necessary to convey complex financial information clearly. g) Proven ability to successfully work with a big team. h) High attention to detail and commitment to accuracy. i) Experience mentoring and guiding Junior Analysts is a plus. |

Salary Insights for Financial Modelling Positions

The Salary of a Financial Analyst changes according to different positions. Let’s look at some of those positions in the below table.

|

Position |

Average salary (per year) |

Additional cash compensation (per year) |

|

Financial Modelling Analyst |

£29,000 - £40,000 |

£3,000 - £5,000 |

|

Junior Financial Modelling Analyst |

£22,000 - £32,000 |

£1,500 - £3,000 |

|

Senior Financial Modelling Analyst |

£29,000 - £47,000 |

£5,000 - £10,000 |

|

Financial Analyst |

£30,000 - £50,000 |

£2,000 - £4,000 |

|

Modelling Analyst |

£32,000 - £51,000 |

£4,000 - £6,000 |

Source: Glassdoor

Advance your career with our Accounting Training – Join now!

Conclusion

A Financial Modelling Job can be a game-changer for a business, pinpointing the sweet spots for higher profits. These models empower Financial Analysts to weigh the pros and cons of new projects cost-effectively, saving a company from sinking funds into low-return ventures. A firm’s Financial Models are like growth engines, identifying areas ripe for investment that can spark more opportunities and fatten the profit margins.

Want to increase your financial expertise? Join our Financial Modelling Course today!

Frequently Asked Questions

A Financial Modelling professional creates detailed Financial Models to analyse and forecast a company's financial performance. They use these models for decision-making, evaluating investments, mergers, and acquisitions, and planning business strategies. Their role is crucial in providing insights and supporting strategic financial decisions.

Yes, you can get a job in Financial Modelling with the right qualifications and skills. A degree in finance, accounting, or a related field is typically required. Proficiency in Financial Modelling software, strong analytical skills, and experience in financial analysis are essential. Networking, internships, and relevant certifications can also enhance your job prospects.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Financial Modelling, Payroll and Financial Management. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our Business Skills Blogs covers a range of topics related to Financial Modelling, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Modelling skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Modelling Course

Financial Modelling Course

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please