We may not have the course you’re looking for. If you enquire or give us a call on 44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you interested in a job role that involves managing investments, analysing financial data, and making informed decisions? If so, becoming a Portfolio Manager might be the perfect fit for you. One of the most asked questions from aspirants from this field is: How to Become a Portfolio Manager?

This blog will explore in detail on How to Become a Portfolio Manager and the path to becoming a successful Portfolio Manager. Whether you're starting out or looking to advance your finance career, this blog will provide you with valuable insights and actionable steps to achieve your goals.

Table of Contents

1) What is a Portfolio Manager, and what do they do?

2) How to Become a Portfolio Manager?

a) Educations and certifications

b) Skills required

c) Gaining relevant experience

d) Networking and building connections

e) Keeping up with market trends

3) Career prospects and salary potential for a Portfolio Manager

4) Conclusion

What is a Portfolio Manager, and what do they do?

A Portfolio Manager is an expert in investment management. They oversee a portfolio of assets, such as bonds, stock, mutual funds, or real estate, and ensure that it aligns with the investment objectives and risk appetite of their clients. They conduct thorough research, analyse market trends, and make informed investment decisions to optimise the portfolio's performance. Portfolio Managers make strategic decisions to maximise returns and mitigate risks based on their client's investment goals and risk tolerance.

Portfolio Managers have various responsibilities to fulfil. These may include:

a) Conducting market research and analysis

b) Developing investment strategies

c) Making buy and sell decisions

d) Monitoring portfolio performance

e) Assessing and managing risks

f) Communicating with clients and stakeholders

g) Staying updated with industry trends and regulations

Deliver strategic value and lay a solid foundation by mastering Portfolio Management with the Management Of Portfolios (MOP) Foundation course!

How to Become a Portfolio Manager?

Currently, Portfolio Managers have become one of the hottest prospects in the job market. With the diversity of investment opportunities available currently, thoroughly understanding the qualifications to become one has become necessary. A strong Portfolio Manager Resume highlights a solid foundation in finance and economics, coupled with practical experience in portfolio management or a related field.

Listed below are the key requirements to become a Portfolio Manager:

Education and certifications

a) Academic qualifications: A solid educational foundation forms the cornerstone of your career as a Portfolio Manager. While a bachelor's degree in finance, economics, or any related field is typically the minimum requirement, pursuing a master's degree can provide you with a competitive edge. Consider enrolling in an MBA (Master of Business Administration) program with a specialisation in finance or a specialised finance program that delves deeper into investment management.

b) Professional qualifications: In addition to formal education, acquiring relevant professional certifications can significantly enhance your credentials and demonstrate your expertise to potential employers. The Chartered Financial Analyst (CFA) title is one of the most respected and recognised certifications in the finance industry. It is globally recognised and signifies a high level of competence in investment analysis and portfolio management.

Apart from the CFA, there are other certifications you may consider, such as the Financial Risk Manager (FRM) designation, Certified Investment Management Analyst (CIMA) certification, or the Chartered Alternative Investment Analyst (CAIA) designation. These certifications specialise in risk management, investment advisory, and alternative investments, respectively. Research these certifications to determine which aligns best with your career goals and interests.

c) Continuing education: Professional associations and organisations, such as the Chartered Financial Analyst (CFA) Institute, offer various resources for continuing education. They provide access to industry research, publications, webinars, and networking opportunities. Engaging in these activities not only expands your knowledge base but also demonstrates your commitment to staying current in the field.

2) Skills required

a) Strong analytical and critical thinking abilities

b) Excellent decision-making skills

c) Sound understanding of financial markets and investment instruments

d) Proficiency in data analysis and financial modelling

e) Effective communication and interpersonal skills

f) Ability to manage several tasks and prioritise effectively

g) Ethical conduct and attention to detail

3) Gaining relevant experience

Building a solid foundation of experience is crucial to becoming a Portfolio Manager. Consider starting your career as a financial analyst, investment associate, or research assistant to gain exposure to investment analysis, asset valuation, and portfolio management. By understanding the Portfolio Manager Job Description, you can better align your career path and seek opportunities to work with experienced professionals to learn from their expertise.

4) Networking and building connections

Networking plays a vital role in the financial industry. Attend industry conferences, join professional organisations, and engage with peers and mentors in the field. Building a robust professional network can open doors to new opportunities, provide valuable insights, and help you stay updated with industry trends.

5) Keeping up with market trends

The financial industry is dynamic and constantly evolving. Stay updated with market trends, economic indicators, and industry news. Subscribe to financial publications, follow reputable sources, and participate in online forums or communities to stay informed about the latest market developments.

Learn new methodologies for portfolio management! Register for the Management Of Portfolios (MoP®) Foundation & Practitioner course today!

Career prospects and salary potential for a Portfolio Manager

Career prospects in Portfolio Management worldwide are promising, with several opportunities for growth and advancement. Here are some key employment opportunities to consider regarding career prospects in this field:

a) Financial institutions: Major financial institutions, including banks, asset management firms, and investment companies, often have dedicated portfolio management teams. These institutions offer portfolio managers a wide range of career opportunities, including entry-level positions and senior leadership roles.

b) Wealth management: The wealth management sector is another area that offers substantial career prospects for portfolio managers. High-net-worth individuals, families, and institutional clients rely on portfolio managers to safeguard and grow their wealth. Working in wealth management can provide exposure to complex and diverse investment strategies.

c) Investment advisory firms: Investment advisory firms provide specialised services to individual and institutional clients, offering guidance and recommendations on investment decisions. Portfolio managers are crucial in these firms, providing tailored investment solutions and managing client portfolios based on their unique objectives and risk profiles.

d) Pension funds and insurance companies: Pension funds and insurance companies manage substantial portfolios and require professional portfolio managers to ensure the long-term growth and sustainability of their assets. These institutions often offer attractive career opportunities with competitive compensation packages.

e) Private equity and venture capital: Venture capital and private equity firms focus on investments in privately-held companies, startups, and early-stage businesses. Portfolio managers in these firms assess investment opportunities, make strategic decisions, and manage investment portfolios in pursuit of attractive returns.

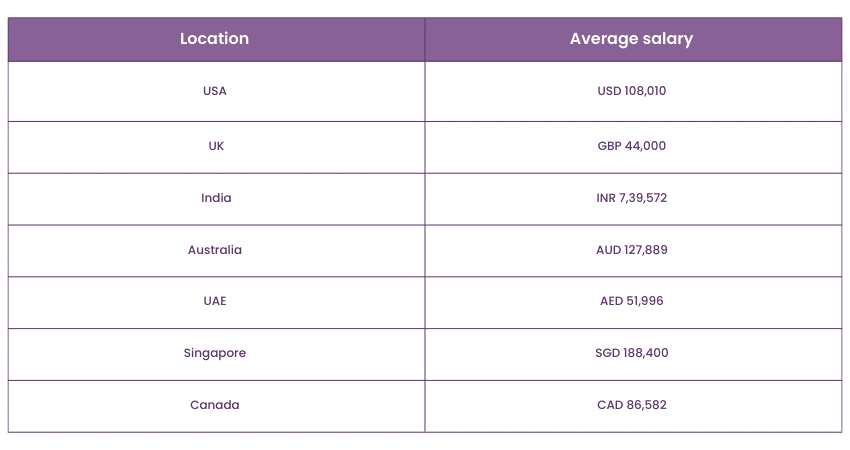

Listed below are the salaries for Portfolio Managers worldwide:

Conclusion

Becoming a Portfolio Manager requires a combination of education, experience, portfolio manager skills, and continuous learning. A strong set of Portfolio Manager Skills, including analytical abilities, risk management, and strategic thinking, is essential to succeed in this role. It is a rewarding career path that allows you to make an impact on a client's financial well-being.

We hope this blog was helpful in figuring out How to Become a Portfolio Manager and the career prospects available with this job role. By following the steps outlined in this career guide and remaining dedicated to professional development, you can pave the way to a successful career as a Portfolio Manager.

Enhance your approach to portfolio management and seek to achieve organisational excellence with our comprehensive Management of Portfolios (MoP) courses!

Upcoming Business Skills Resources Batches & Dates

Date

Management of Portfolios (MoP®) Foundation & Practitioner

Management of Portfolios (MoP®) Foundation & Practitioner

Mon 23rd Jun 2025

Mon 22nd Sep 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please