We may not have the course you’re looking for. If you enquire or give us a call on 44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you newly venturing into the world of Cryptocurrency investment? Do you find Cryptocurrency’s unregulated and decentralised nature exhilarating? But you are still unaware of How to Invest in Cryptocurrency? What are the initial steps, and how can you ensure that your investments are sound?

Whether you’re a curious beginner or a seasoned trader, understanding How to Invest in Cryptocurrency is essential. In this blog, we’ll demystify the process, exploring everything from blockchain intricacies to selecting the perfect trading platform. By the end, you’ll be equipped to confidently build your crypto portfolio and ride the digital wave!

Table of Contents

1) What is Cryptocurrency?

2) The Different Types of Cryptocurrencies

3) Steps on How to Invest in Cryptocurrency

4) Other Ways to Invest in Cryptocurrency

5) Strategies for Investing in Cryptocurrency

6) Secure your Cryptocurrency Investments

7) Conclusion

What is Cryptocurrency?

Cryptocurrency works as a digital form of currency, similar to conventional money, and is used for buying goods and services. It also acts as an investment instrument comparable to other financial assets, offering opportunities for economic returns. It's crucial to recognise, however, that Cryptocurrencies are highly susceptible to significant price swings, rendering them a volatile category of assets.

These digital currencies are decentralised, meaning they aren't created, backed, or regulated by any central authority. Often called coins or tokens, they are produced through a digital verification method rooted in Blockchain technology. The Blockchain, with uses extending beyond Cryptocurrencies, is a powerful framework that protects and encodes the value and transaction details of each Cryptocurrency.

The Different Types of Cryptocurrencies

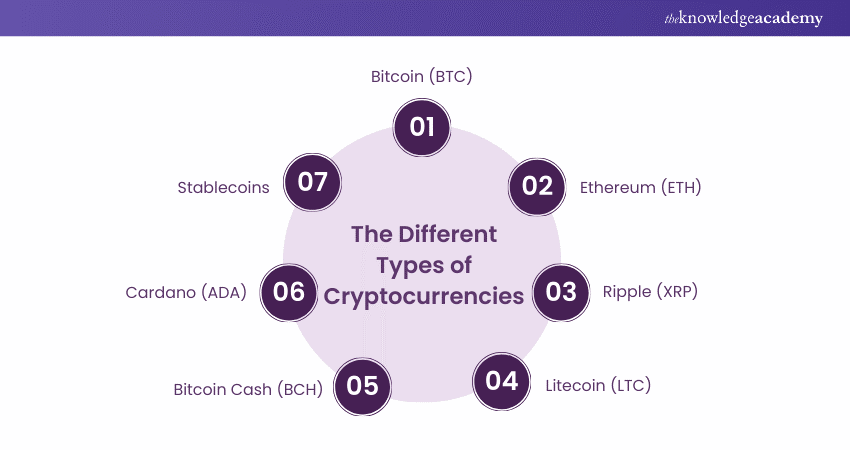

Cryptocurrencies come in diverse forms, each with unique features and uses. Here are some of the most prominent Types of Cryptocurrencies:

1) Bitcoin (BTC): Bitcoin is the pioneer of Cryptocurrency, and it is the most recognised and widely used. It was the first digital currency to employ Blockchain technology, paving the way for other Cryptocurrencies.

2) Ethereum (ETH): Known for its versatile platform, Ethereum goes beyond being just a Cryptocurrency. It provides smart contracts and Decentralised Applications (DApps), offering a broader range of uses than Bitcoin.

3) Ripple (XRP): Ripple, or XRP, is primarily noted for its electronic payment system more than for its status as a Cryptocurrency. It's used primarily for real-time cross-border financial transactions and is favoured by banks and financial institutions.

4) Litecoin (LTC): Often regarded as the silver to Bitcoin's gold, Litecoin is designed for faster and cheaper transactions. It was one of the first Cryptocurrencies to adopt Segregated Witness (SegWit), a method for increasing transaction capacity.

5) Bitcoin Cash (BCH): A spin-off from Bitcoin, Bitcoin Cash was created to allow for more transactions to be processed and improve scalability.

6) Cardano (ADA): Cardano is unique in its research-driven approach, focusing on security, sustainability, and scalability. It employs a Proof-of-Stake (PoS) algorithm and aims to bring more balance to the Cryptocurrency ecosystem.

7) Stablecoins: These are a type of Cryptocurrency that aims to offer price stability. They are typically pegged to a reserve asset, like the U.S. Dollar, gold, or another Cryptocurrency.

Steps on How to Invest in Cryptocurrency

Investing in Cryptocurrency can be an extremely rewarding journey, but it requires meticulous planning and consideration. Let's explore How to Invest in Cryptocurrency with detailed steps:

1) Choose What Cryptocurrency to Invest in

Before investing in Cryptocurrencies, it’s vital to evaluate their characteristics as you would a company’s financial health. Consider investing in one or diversifying your portfolio. Due diligence is key to avoid fraud, such as pump-and-dump schemes. Stay cautious of obscure or new Cryptocurrencies and their aggressive promotion online. Using well-known platforms can lessen, but not eliminate, the risk of fraud and cyber threats.

For instance, remember the FTX scandal of 2022, where the trusted platform’s founder, Sam Bankman-Fried, was convicted of fraud and money laundering.

2) Select a Cryptocurrency Exchange

Purchasing Cryptocurrency necessitates the use of an exchange or investment platform, such as Coinbase, Gemini, or Kraken. When selecting an exchange, consider factors like security measures, transaction fees, trading volume, minimum investment thresholds, and the assortment of Cryptocurrencies available.

3) Consider Storage and Digital Wallet Options

Given that Cryptocurrency is entirely digital, secure storage is paramount. Many investors prefer to keep their assets on the investment platform itself, which often provides custodial services and safeguards against online threats backed by financial insurance. Alternatively, you can use a Crypto wallet to store your private keys. It is considered essential for accessing your Cryptocurrency.

Wallets come in two forms: “hot” wallets, which are internet-connected and convenient, and “cold” wallets, which are offline physical devices offering enhanced security.

4) Decide how Much to invest

The sum you Invest in Cryptocurrency should align with your financial capacity, risk appetite, and investment strategy. Crypto exchanges typically accommodate investments of any size, allowing you to invest fractional amounts in high-value Cryptocurrencies like Bitcoin. Focus on the total investment amount rather than the quantity of coins.

Always ensure that the amount you invest is within your financial means and does not exceed what you can comfortably part with.

5) Manage Your Investments

Cryptocurrency serves as a double investment vehicle. On one hand it serves as money, where you can buy goods and services just as it’s you’d do it with other forms of money. On the other hand, it can also be considered as a tangible asset which can be bought like a share instead of a fixed deposit with an expectation to gain over a period of time.

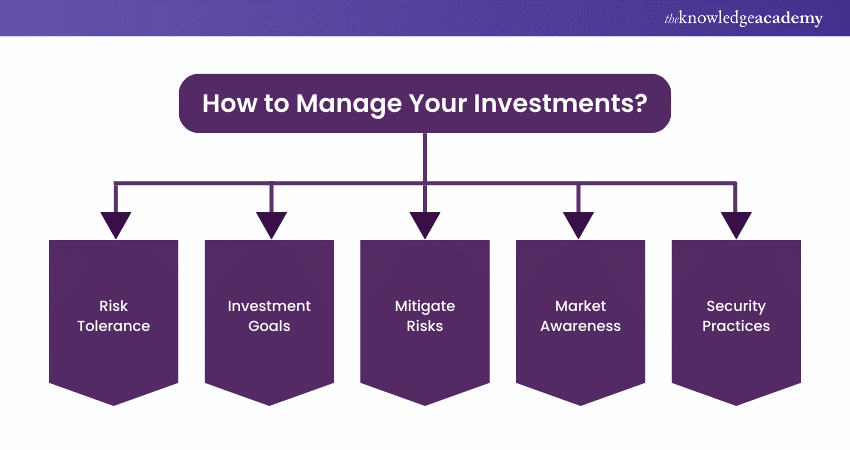

Cryptocurrency investment should be managed in relation to the personal investment objectives and plans witnessed in the Cryptocurrency market. Let's explore some key considerations for managing your investments:

1) Risk Tolerance: Given the high volatility of Cryptocurrencies, determine your comfort level with market fluctuations.

2) Investment Goals: Short-term Traders might focus on immediate price movements, whereas long-term investors may adopt a 'buy and hold' strategy.

3) Mitigate Risks: Mitigate risks by spreading investments across various Cryptocurrencies.

4) Market Awareness: Stay informed about the dynamic Crypto market, including trends and regulatory changes.

5) Security Practices: Ensure the security of your digital assets with robust online security measures and secure wallets.

Balancing these factors will help you tailor your Cryptocurrency investment approach to meet your financial objectives and risk tolerance.

Initiate your journey to financial freedom with our Investment and Trading Course – join us now and learn the secrets to profitable trading.

More Ways to Invest in Cryptocurrency

While direct investment in Cryptocurrencies is a common approach, there are alternative methods for participating in the Cryptocurrency market, each with varying degrees of involvement. These alternatives include:

a) Crypto Futures: Futures contracts offer a speculative method to bet on Bitcoin’s price fluctuations. By employing leverage, traders can amplify their returns—or incur substantial losses. The rapid pace of the futures market intensifies the inherent volatility of Cryptocurrency.

b) Bitcoin ETFs: Such spot Bitcoin Exchange-traded Funds (ETFs) are accessible via most online brokerage platforms that also handle conventional assets such as stocks and bonds. Additionally, these ETFs provide a straightforward avenue for investing in Cryptocurrency through a fund-like structure.

c) Crypto Exchange or Broker Stocks: Investing in shares of companies that stand to benefit from the growth of Cryptocurrency—regardless of which currency prevails—is another intriguing strategy. This is the appeal of platforms like Coinbase or brokers like Robinhood, which earn a significant portion of their revenue from Cryptocurrency transactions.

d) Blockchain ETFs: Blockchain ETFs enable investment in businesses that are likely to gain from the development of Blockchain technology. Leading Blockchain ETFs offer investment exposure to prominent publicly traded companies within this sector. However, these companies’ diverse operations may reduce your direct Cryptocurrency market exposure, balancing the associated risks and benefits.

Strategies for Investing in Cryptocurrency

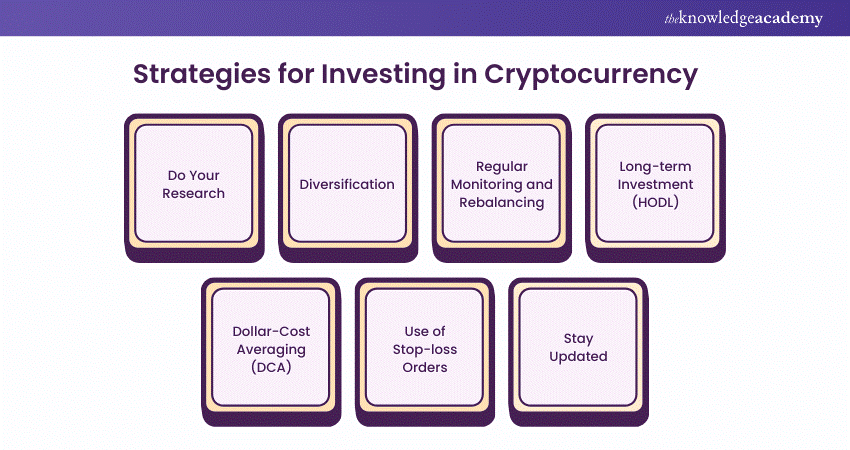

Before you start Investing in Cryptocurrencies, remember that all investment strategies come with risks.

You should only invest what you can lose and consider consulting a financial advisor. Along with that, you can also follow these strategies when you are investing in Cryptocurrencies:

1) Do Your Research: Start with a comprehensive understanding of the various types of Cryptocurrencies, their uses, and their potential for growth. Cryptocurrencies like Bitcoin and Ethereum are well-known, but there are thousands of other options, each with unique features and potential.

2) Diversification: Avoid investing all of your funds in a single Cryptocurrency. Creating a varied investment portfolio across multiple Cryptocurrencies can help offset the risk of underperformance in any single asset. Such a portfolio might combine well-known Cryptocurrencies, such as Bitcoin and Ethereum, with newer, up-and-coming options. 3) Regular Monitoring and Rebalancing: The crypto market is extremely volatile and requires regular monitoring. Watch for market trends and adjust your portfolio as necessary. Constant rebalancing ensures that your portfolio aligns with your investment goals and risk tolerance.

4) Long-term Investment (HODL): Hold on for Dear Life (HODL) is a very popular strategy among Crypto Investors. It involves buying and holding onto a Cryptocurrency for a long period. This signifies that you can hold on despite short-term market fluctuations. You can use this strategy in the hope that it will increase in value over time.

5) Dollar-Cost Averaging (DCA): This strategy requires investing a fixed amount in a certain Cryptocurrency at regular intervals, regardless of its price. This strategy can mitigate the impact of volatility, as you buy more coins when prices are low and fewer when prices are high.

6) Use of Stop-loss Orders: Stop-loss orders can protect your investment from significant losses. They allow you to set a specific price at which your Cryptocurrency will be sold automatically if the market price drops to that level.

7) Stay Updated: The world of Cryptocurrency evolves quickly. Stay updated with the recent news and trends, and continuously educate yourself. This latest information can help you make informed decisions on investments.

Dive into the world of digital finance with our course on Cryptocurrency Trading Training - sign up now!

Secure Your Cryptocurrency Investments

Ensuring the reliability of your Cryptocurrency investments is a distinctive challenge within this investment domain. Here are some strategies to enhance the safety of your crypto assets:

a) Select Trustworthy Platforms: Engage exclusively with well-established and credible Cryptocurrency exchanges and digital wallet services. These platforms should have a proven track record of reliability and robust security measures.

b) Fortify Access Controls: Implement stringent security practices to access your crypto holdings. Employ intricate passwords, activate dual-factor verification, and ascertain the security of your internet connection, particularly during financial dealings.

c) Stay Alert to Scams: Cryptocurrency investors are often targets of phishing attempts. Stay updated about the latest scam tactics, and be cautious with unsolicited communications that request sensitive information.

d) Maintain Privacy: Your passwords and private keys are the gatekeepers to your Cryptocurrency. Never disclose them to anyone, and avoid storing them in locations where they could be easily accessed by others.

Following these recommendations can greatly reduce the chances of unauthorised entry into your Cryptocurrency holdings, thereby safeguarding your economic assets.

Increase your knowledge about the forex market with our course on Foreign Exchange Training - Register today!

Conclusion

Within the Cryptocurrency domain, possessing knowledge is your most crucial resource. We hope this blog has illuminated the path on How to Invest in Cryptocurrency, equipping you with the tools to navigate this digital frontier. Embrace the journey with confidence, and let your strategic investments unlock new horizons of financial opportunity.

Learn from experts and develop winning strategies with our Stock Trading Course - register now and start trading like a pro!

Frequently Asked Questions

Investing in Cryptocurrency can broaden your understanding of digital assets and Blockchain technology, which are increasingly important in the finance industry. This expertise is valuable for roles in fintech and for financial institutions that are integrating digital currency innovations.

In the Cryptocurrency job market, essential skills include Blockchain proficiency, digital asset trading knowledge, understanding of regulatory compliance for Cryptocurrencies, and strong analytical abilities. Proficiency in Cyber Security and smart contract development are also in high demand.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. By tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Courses, including Cryptocurrency Trading, Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Investment and Trading methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills Blogs to discover more insights!

Upcoming Business Skills Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please