We may not have the course you’re looking for. If you enquire or give us a call on 44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

With the e-commerce boom in the late 1990s and early 2000s, many businesses and consumers were facing the problem of data breaches, security issues and financial frauds. This is when the PCI Security Standards Council stepped in and established the Payment Card Industry Data Security Standard (PCI DSS) standard. The Purpose of PCI DSS was to establish a comprehensive standard to reduce security breaches and provide a way for businesses to secure their customer’s data. Explore the Purpose of PCI DSS compliance, its role in securing payment card data, and why it is essential for businesses. Read now for more!

Even today, data breaches and financial frauds cause significant losses. According to Statista, the e-commerce industry faced a loss of 32.19 billion GBP in 2022 and 15.68 billion GBP in 2021 because of online payment fraud. Read more to learn more!

Table of Contents

1) What is PCI DSS?

2) The Purpose of PCI DSS

a) Protecting cardholder data

b) Reducing data breach risks

c) Establishing security standards

d) Building customer trust

3) Benefits of PCI DSS compliance

4) Risks of non-compliance with PCI DSS

5) PCI DSS compliance best practices

6) Conclusion

What is PCI DSS?

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security standards enforced by major credit card companies to ensure the secure handling of cardholder data in payment card transactions. Compliance with PCI DSS is obligatory for organisations handling, processing, or storing cardholder information. This adherence to standards protects sensitive data and plays a crucial role in fortifying the overall security infrastructure of businesses. Companies can maintain customer trust and confidence in financial transactions by demonstrating a commitment to the highest data security standards.

PCI DSS compliance goes beyond mere regulatory adherence; it offers a comprehensive framework for effective risk management. Organisations following these standards can proactively identify and address vulnerabilities in their payment card systems, reducing the risk of data breaches and potential financial losses. The PCI DSS framework guides the implementation of crucial security measures like encryption, access controls, and continuous monitoring.

Businesses that prioritise PCI DSS compliance not only meet regulatory requirements but also position themselves to adapt to evolving security challenges, creating a secure environment for electronic payment transactions and upholding the integrity of the entire payment card ecosystem.

To bolster the security of payment card data, the PCI Security Standards Council (SSC) furnishes comprehensive standards and supporting materials. These encompass specification frameworks, tools, measurements, and resources to aid organisations in maintaining cardholder information security, especially during data transmission. At the core of the council's efforts lies the PCI DSS, offering a foundational framework for establishing robust payment card data security systems.

This framework covers prevention, detection, and appropriate responses to security incidents. The PCI SSC provides various tools and resources, including self-assessment questionnaires, PTS requirements, PA-DSS, and lists of qualified assessors and vendors to support compliance and secure practices.

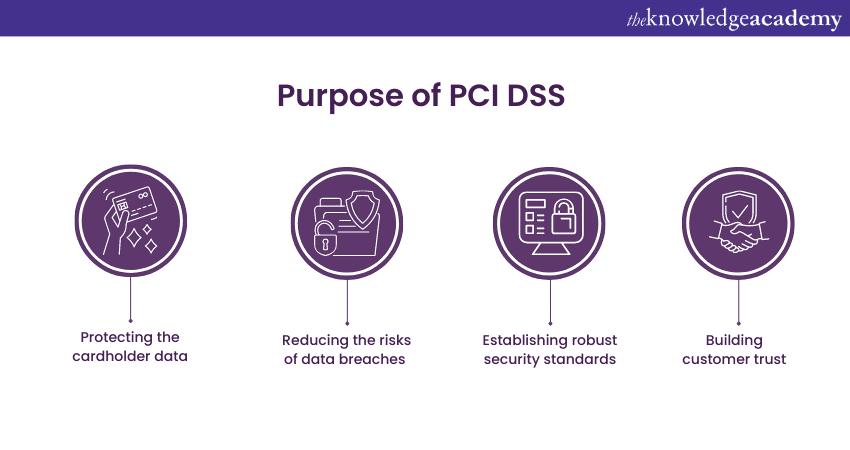

The Purpose of PCI DSS

PCI DSS protects cardholder data and helps businesses establish a strong security foundation, reduce the risk of data breaches, maintain compliance with legal and industry-specific regulations, and build trust with customers.

The primary Purpose of PCI DSS is explained below:

Protecting cardholder data

The primary Purpose of PCI DSS is to safeguard cardholder data from unauthorised access, theft, or compromise. Cardholder data includes sensitive information such as card numbers, names, expiration dates, and security codes. Without adequate protection, malicious actors can exploit this data for fraudulent activities, causing financial losses and reputational damage.

PCI DSS provides a framework of security controls and requirements that businesses must implement to ensure the protection of cardholder data throughout its lifecycle. It emphasises the need for encryption, secure storage, and data transmission, limiting access only to authorised individuals with a legitimate business need. By adhering to these guidelines, organisations can effectively minimise the risk of data breaches and safeguard the entrusted sensitive information.

Reducing data breach risks

Data breaches pose a substantial risk to businesses and their customers. Such incidents can result in severe financial and legal repercussions and the loss of customer trust. PCI DSS aims to mitigate these risks by establishing robust security practices and measures.

The standard mandates the implementation of strong security controls, including network firewalls, secure configurations, and regular vulnerability scans. By adopting these measures, businesses can identify and address vulnerabilities promptly, reducing the likelihood of successful attacks and data breaches. PCI DSS also encourages using secure coding practices to prevent the exploitation of software vulnerabilities, further enhancing the overall security posture.

Establishing security standards

Another essential Purpose of PCI DSS is to establish consistent security standards across the payment card industry. The standard provides a unified framework that ensures organisations adhere to best practices and requirements, regardless of size or industry.

By defining specific security controls and measures, PCI DSS helps businesses establish a baseline for Data Security. It sets expectations for the protection of cardholder data, guiding organisations in implementing comprehensive security strategies and practices. Adhering to these standards not only protects businesses from potential breaches but also ensures a level of consistency and accountability throughout the payment card ecosystem.

Building customer trust

PCI DSS compliance plays a crucial role in building and maintaining customer trust. When customers see the PCI DSS compliance seal or know that a business follows the standard's guidelines, they gain confidence that their payment card data is handled securely.

Compliance with PCI DSS demonstrates a commitment to Data Security and customer privacy. It reassures customers that their sensitive information is protected and that the business has taken the necessary steps to minimise the risks of data breaches. This trust enhances the relationship between businesses and their customers and contributes to long-term customer loyalty and brand reputation.

Learn the essentials of PCI DSS and comply with the standard with our PCI DSS Foundation Training today!

Benefits of PCI DSS compliance

Complying with the PCI DSS offers numerous benefits for businesses. Let's explore the benefits of PCI DSS compliance:

a) Enhanced security

Compliance with PCI DSS leads to improved security procedures, reducing the risk of data breaches and cyber-attacks. Regular security assessments and vulnerability scans help identify and address vulnerabilities, strengthening overall security.

b) Legal and regulatory compliance

PCI DSS compliance ensures businesses meet legal and industry-specific regulations related to Data Security. By aligning with these requirements, organisations avoid costly penalties, legal actions, and potential disruptions to their operations.

c) Protection of brand reputation

PCI DSS compliance enhances brand reputation by demonstrating a commitment to Data Security. Customers trust businesses that prioritise protecting their payment card data, leading to increased customer confidence, loyalty, and positive brand perception.

d) Customer trust and confidence

Compliance with PCI DSS builds trust and confidence among customers. Displaying the PCI DSS compliance seal reassures customers that their sensitive payment card information is handled securely, fostering long-term relationships and encouraging repeat business.

e) Cost savings

Implementing PCI DSS controls and practices can lead to cost savings in the long run. By preventing data breaches and associated financial liabilities, businesses avoid the expenses related to breach remediation, legal actions, and potential regulatory fines.

f) Efficient business operations

Compliance with PCI DSS often necessitates the implementation of standardised processes, robust security protocols, and regular monitoring. These practices can streamline business operations, improve efficiency, and enhance organisational resilience.

Learn how to implement effective security governance and compliance programs with our Security Governance And Compliance Training.

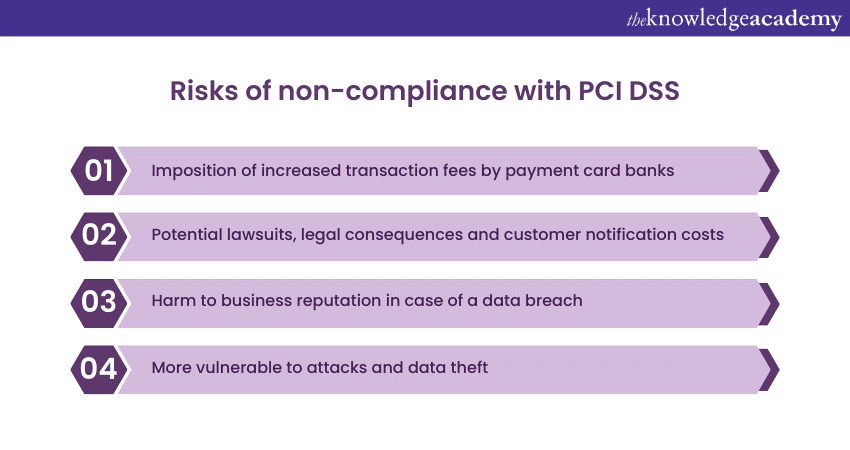

Risks of non-compliance with PCI DSS

While achieving and maintaining compliance with the PCI DSS may require time, effort, and resources, the risks associated with non-compliance can far outweigh the costs of implementing security measures. Failing to meet the requirements of PCI DSS can expose businesses to significant vulnerabilities and potentially severe consequences.

a) Payment card brands and acquiring banks can impose significant fines, increase transaction fees, or suspend card processing privileges for non-compliance.

b) Non-compliance can lead to legal consequences, including forensic investigations, customer notification costs, settlements, and potential lawsuits.

c) Data breaches resulting from non-compliance can harm a business's reputation, resulting in a loss of trust, customers, and long-term brand damage.

d) Non-compliance leaves businesses more vulnerable to cyber-attacks and theft of card holder data.

e) Non-compliance erodes customer trust, resulting in customer attrition and negative word-of-mouth, impacting business growth.

Learn how to implement PCI DSS and keep your customers' data safe with our PCI DSS Implementer Training today.

PCI DSS compliance best practices

There exist several best practices aiding businesses in adhering to PCI DSS and sustaining a secure environment for transmitting cardholder data. The following are the PCI DCC compliance best practices:

1) Restricting the storage of cardholder data and essential business information.

2) Establishing a comprehensive compliance program with strategic objectives, roles, robust password policies, and procedural guidelines.

3) Formulating performance metrics for evaluating compliance effectively.

4) Assigning compliance responsibilities to knowledgeable and capable staff.

5) Crafting additional security requirements tailored to the organisation and its industry.

6) Regularly monitoring, testing, and addressing security vulnerabilities.

7) Establishing processes for detecting and rectifying security failures and breaches.

8) Instilling and sustaining security awareness to counter social engineering threats like phishing and scareware.

9) Monitoring vendor service providers' compliance.

10) Allocating resources for adapting compliance programs to evolving cybersecurity threats.

PCI SSC advises companies to develop their own requirements and practices, emphasising self-monitoring and risk-based approaches. Regular policy and procedure reviews, coupled with employee education, reinforce the significance of PCI DSS compliance. Collaborating with experts like QSAs and ASVs assists businesses in assessing, implementing, and sustaining PCI DSS compliance.

Conclusion

The Purpose of PCI DSS is to establish a comprehensive framework that protects sensitive payment card data, mitigates the risks of data breaches, ensures legal compliance, enhances brand reputation, and promotes customer trust. Embracing PCI DSS compliance is crucial for businesses to secure their operations, safeguard customer information, and thrive in the ever-evolving landscape of online transactions.

Develop the skills you need to deliver compliance training that is effective and compliant with regulatory requirements with our Effective Compliance Training.

Frequently Asked Questions

Businesses can ensure ongoing PCI DSS compliance by implementing robust security measures, conducting regular risk assessments, educating employees on security protocols, employing encryption technologies, and regularly updating and monitoring systems. Continuous training, maintaining documentation, and conducting periodic audits contribute to a proactive approach, fostering a culture of security awareness to protect sensitive cardholder data.

Understanding the purpose and importance of PCI DSS is crucial for businesses as it enhances customer trust, mitigates the risk of data breaches, and avoids hefty penalties. Compliance fosters a secure environment, safeguards sensitive data, and aligns with industry best practices. Additionally, it minimises the financial and reputational damage associated with security incidents, opening avenues for global transactions and partnerships by demonstrating a commitment to data security and regulatory compliance.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Compliance Trainings, including Corporate Governance Course and Security Governance and Compliance Training. These courses cater to different skill levels, providing comprehensive insights into various Compliance Frameworks.

Our Compliance Training blogs covers a range of topics related to ISO and Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 16th Jan 2025

Thu 6th Mar 2025

Thu 22nd May 2025

Thu 24th Jul 2025

Thu 25th Sep 2025

Thu 11th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please