We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ever looked for investment choices that can grow your wealth besides funding reforestation projects that combat climate change? This is the transformative potential of Socially Responsible Investment (SRI). It lets you align your financial goals with your ethical values, ensuring that your money supports businesses and initiatives that foster social and environmental progress.

Be it through backing renewable energy ventures or investing in community development, Socially Responsible Investment offers a way to make your investments impactful. In this complete blog, we will explore its diverse aspects, providing you with the insights and tools to make informed, meaningful investment decisions. Let’s dive in!

Table of Contents

1) What is a Socially Responsible Investment?

2) Types of Socially Responsible Investments

3) How can you Make Socially Responsible Investments?

4) Differences Between SRI and ESG

5) Example of Socially Responsible Investment

6) Conclusion

What is a Socially Responsible Investment?

Socially Responsible Investment, also known as social funding, entails making Investments which are deemed socially accountable and based on the character of the agency’s enterprise sports. One of its prevalent themes includes socially conscious investing.

These investments can be directed towards individual companies with strong social values or through socially conscious mutual funds or Exchange-traded Funds (ETFs).

Types of Socially Responsible Investments

Socially Responsible Investments (SRIs) come in various forms, each catering to different investor preferences and values. Such investments focus on generating financial returns while promoting positive social and environmental outcomes. Below are some common types of SRIs:

1) Mutual Funds and Exchange-Traded Funds (ETFs)

Many mutual funds and ETFs follow the Environmental, Social, and Governance (ESG) criteria. Investors interested in these funds can visit the SIF website, which lists over 100 socially responsible mutual funds.

2) Community Investments

Investors can also directly fund projects that benefit communities. One straightforward method is to contribute to Community Development Financial Institutions (CDFIs).

3) Microfinance

Another approach to making Socially Responsible Investments is by providing microloans or small loans to startups.

Investors can seek out businesses in developing countries that offer financial assistance, thereby fostering economic growth and community development.

Empower yourself by signing up for our Personal Development Courses – secure your spot now!

How can you Make Socially Responsible Investments?

Making Socially Responsible Investments lets you align your financial dreams with your private values. By choosing investments that promote fine social and environmental effects, you can make contributions to a better global whilst probably earning returns. Here are a few approaches you can consider to make SRIs:

1) Negative Screening

This method includes evaluating a business enterprise’s practices, merchandise, and/or services before deciding to make investments. If a potential investor discovers that a business enterprise produces dangerous merchandise like cigarettes, or engages in unethical practices, they'll choose not to make investments.

2) Positive Investing

In this method, an investor selects organisations, whose practices they approve of. For example, if a person is obsessed with the environment, their portfolio will possibly consist of investments in green strength. This additionally approach might best collaborate with businesses that adhere to sustainable practices.

3) Community Investing

For those inquisitive about SRI community, making an investment is a super technique. It entails making an investment in initiatives that economically gain local groups, which include people who utilise local assets and create possibilities for the deprived.

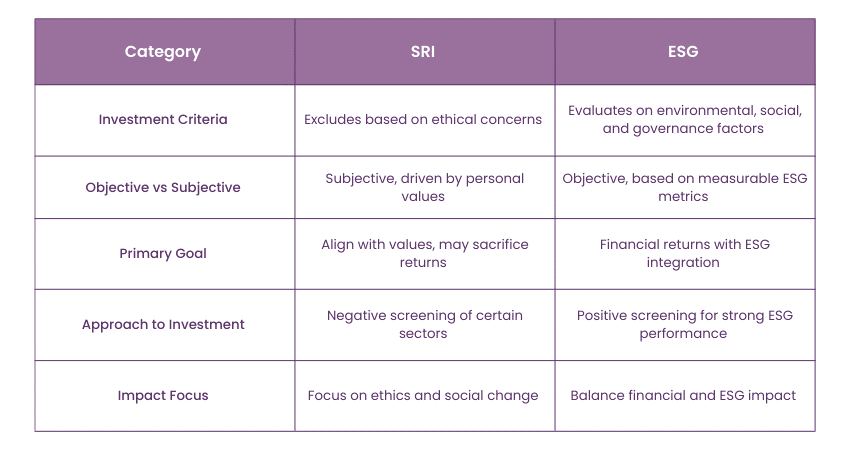

Differences Between SRI and ESG

Here are five detailed points highlighting the differences between Socially Responsible Investment and Environmental, Social, and Governance (ESG):

1) Investment Criteria

SRI makes a speciality of excluding investments, that are based totally on precise moral standards. For instance, an investor might keep away from groups involved in tobacco or firearms. Whereas, ESG evaluates organisations based on their environmental, social, and governance practices alongside conventional economic metrics. It focuses on discovering dangers and opportunities associated with those factors.

2) Objective vs Subjective

SRI regularly involves a subjective assessment of an enterprise’s alignment with the investor’s private values and ethical requirements. While, ESG makes use of objective criteria to measure an employer’s performance in environmental, social, and governance areas. This information is used to complement monetary evaluation.

3) Primary Goal

The primary intention of SRI is to spend money on a way that aligns with the investor’s moral beliefs, even if it means doubtlessly sacrificing some economic returns. However, ESG goals to decorate financial performance by means of integrating ESG elements into funding selections, identifying groups that would perform properly over the long time because of their sustainable practices.

Unlock your full potential by registering for our expert-led Time Management Training – sign up today and transform your productivity!

4) Approach to Investment

SRI involves actively avoiding investments in companies that do not meet certain ethical standards. It is more about exclusion based on values. Whereas, ESG involves evaluating and selecting companies that perform well on ESG criteria, often leading to a more inclusive approach that considers both financial and non-financial factors.

5) Impact Focus

SRI emphasises the ethical effect of investments, regularly prioritising social and environmental advantages over economic returns. In contrast, ESG specialises in how ESG elements can impact an organisation’s overall economic performance and lengthy-term sustainability, aiming to balance moral considerations with financial returns.

Example of Socially Responsible Investment

An instance of Socially Responsible Investment is community investing, which without delay supports companies with a demonstrated tune report of social obligation through community help. Such companies regularly face demanding situations in obtaining funding from conventional assets like banks and monetary establishments. The monetary help they acquire permits them to offer critical offerings to their communities, which includes low-cost housing and loans. The intention is to enhance the first-rate existence in the community by means of lowering reliance on authorities' help, including welfare, thereby positively impacting the local financial system.

Conclusion

In conclusion, Socially Responsible Investment (SRI) empowers you to make monetary selections that replicate your moral values, thereby fostering an effective impact on society. By integrating SRI into your portfolio, you can aim for financial returns and make a contribution to a sustainable future. Start exploring SRI options and align your investments with your values.

Forge deeper and more meaningful connections by joining our Emotional Intelligence Training today!

Frequently Asked Questions

Sustainable and Responsible Investing can make a difference beyond financial returns by positively impacting Environmental, Social, and Governance (ESG) issues.

SRI aligns investments with ethical values, promoting sustainability and social responsibility. However, risks exist, such as lower diversification, potential underperformance compared to traditional investments, and limited options in certain sectors.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses, including the Time Management Training, Journalism Course, and Social Responsibility Course. These courses cater to different skill levels, providing comprehensive insights into Budget Deficit.

Our Business Skills Blogs cover a range of topics related to Social Responsibility, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Social Responsibility Course

Social Responsibility Course

Fri 6th Dec 2024

Fri 7th Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 8th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please