We may not have the course you’re looking for. If you enquire or give us a call on +1 7204454674 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine owning a property that not only provides a place to live or do business but also builds wealth over time. That’s the power of Real Estate Investment! Whether you are looking to earn rental income, watch your property's value grow, or explore different types of real estate, investing in property offers endless opportunities.

In this blog, we break down what Real Estate Investment is, the benefits it offers, and the smart strategies you can use to make the most of your investment. Ready to learn? Let’s get started!

Table of Contents

1) Understanding Real Estate Investment

2) Types of Real Estate Investment

3) Benefits of Real Estate Investment

4) Real Estate Investment Strategies

5) Conclusion

Understanding Real Estate Investment

Real Estate Investment means buying, owning, managing, or selling properties to make money. Unlike stocks or bonds, real estate is something you can see and use. People invest in real estate to create wealth, earn rental income, or diversify their investments.

There are many ways to invest in real estate, such as buying a home to live in, renting out extra properties, or owning commercial buildings. The main goal is to increase the investment’s value over time, either by earning rent or selling the property for a profit when its value goes up.

Types of Real Estate Investment

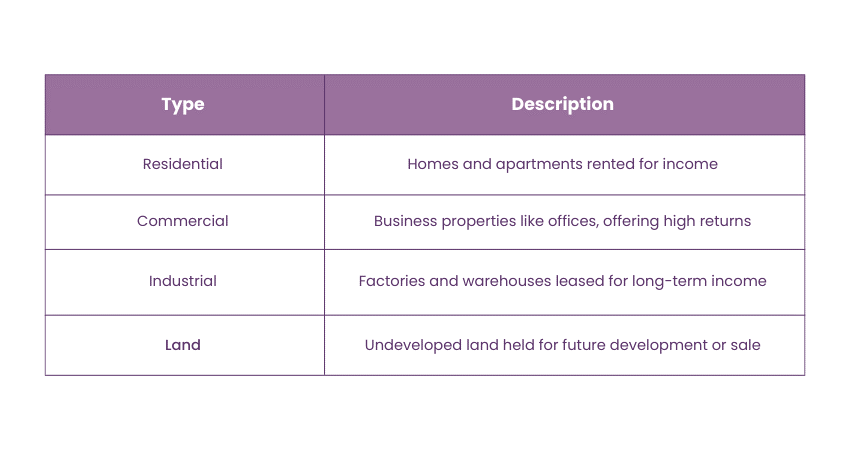

Here are the types of Real Estate Investment:

1) Residential

Properties where people live, making it the most common investment type for beginners

Examples: Single-family homes, duplexes, townhouses, apartments

Key Benefits:

a) Regular rental income potential

b) Lower entry barrier

c) Simpler management

d) More beginner-friendly

2) Commercial

Business-focused properties that often yield higher returns but require more expertise.

Examples: Office buildings, retail spaces, shopping centres

Key Benefits:

a) Higher initial investment

b) Potentially greater returns

c) Longer-term business leases

d) Higher rental rates

3) Industrial

Large-scale properties for manufacturing, storage, and distribution.

Examples: Factories, manufacturing plants, distribution centres

Key Benefits:

a) Long-term corporate leases

b) Stable income streams

c) Lower maintenance needs

4) Land

Purchasing undeveloped property for future use or appreciation.

Examples: Raw land, Agricultural land, Development plots, Infill lots

Key Benefits:

a) Offers higher returns investment on investment

b) Can be developed into agricultural, commercial or residential properties

c) Requires minimal maintenance

d) May offer various tax benefits depending on the locality

Learn investment strategies with our Investment Management Course – Join today!

Benefits of Real Estate Investment

Here are some of the key advantages:

1) Value Appreciation

Real estate often increases in value over time. When the market is good, property prices go up, allowing investors to sell for more than they paid. This can lead to big profits, especially in high-demand areas.

2) Rental Income

Investors can earn regular income by renting out residential or commercial properties. This rental income can cover the mortgage, maintenance, and other costs, while also providing extra profit.

3) Safe and Secured Option

Real estate is generally safer and more stable compared to stocks or Cryptocurrencies. Property values are less volatile, making it a more predictable long-term investment. Plus, real estate is a physical asset with intrinsic value, which can be used or leveraged even if market conditions change.

4) Tax Benefits

Some of the advantages that investors can claim are mortgage interest, property taxes, operating expenses, and depreciation. These tax incentives can thus reduce the cost of owning and managing property. This makes Real Estate Investment more attractive.

Learn skills to boost the real estate market’s growth with our RERA Course – Join today!

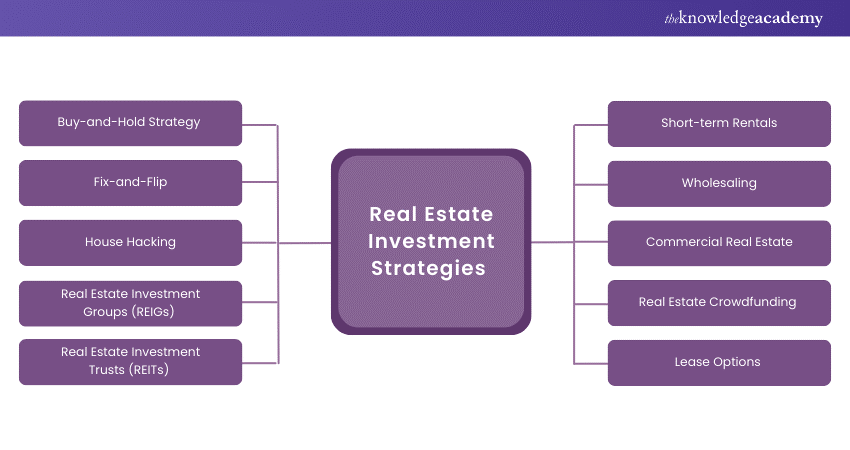

Real Estate Investment Strategies

Here are some common Real Estate Investment techniques:

1) Buy-and-Hold Strategy

a) Long-term property ownership strategy

b) Focus on building equity and wealth over time

c) Popular among traditional real estate investors

How it Works:

a) Purchase property and maintain ownership long-term

b) Rent to tenants for monthly income

c) Hold through market cycles for appreciation

d) Pay down mortgage with rental income

Advantages:

a) Steady monthly rental income

b) Property value appreciation

c) Tax benefits and deductions

d) Equity building through mortgage paydown

e) Hedge against inflation

2) Fix-and-Flip

a) Short-term investment strategy

b) Focus on rapid property transformation

c) Profit through forced appreciation

How it Works:

a) Purchase undervalued or distressed properties

b) Complete strategic renovations

c) Sell quickly at market value

d) Move on to next project

Advantages:

a) Quick return on investment

b) Higher profit potential

c) Development of market expertise

d) No long-term management required

e) Building renovation experience

3) House Hacking

a) Owner-occupant investment strategy

b) Combines personal residence with investment

c) Popular among first-time investors

How it Works:

a) Buy multi-unit property

b) Live in one unit

c) Rent out other units

d) Use rental income for mortgage payments

Advantages:

a) Reduced or eliminated housing costs

b) FHA loan eligibility (lower down payment)

c) Hands-on management experience

d) Tax benefits while building equity

e) Lower risk entry to real estate investing

4) Real Estate Investment Groups (REIGs)

a) Collaborative investment approach

b) Pooled resources and expertise

c) Professional management structure

How it Works:

a) Multiple investors pool money

b) Group purchases and manages properties

c) Profits shared based on investment share

d) Professional management handles operations

Advantages:

a) Shared risk and resources

b) Professional management

c) Lower individual capital required

d) Access to larger deals

e) Network and knowledge sharing

5) Real Estate Investment Trusts (REITs)

a) Securities-based Real Estate Investment

b) Publicly traded companies

c) Highly regulated investment vehicle

How it Works:

a) Purchase shares in REIT companies

b) Company manages property portfolio

c) Regular dividends from rental income

d) Trade shares like stocks

Advantages:

a) High liquidity

b) Professional management

c) Regular dividend income

d) Low minimum investment

e) No direct property management

6) Short-term Rentals

a) Vacation/temporary rental strategy

b) Higher turnover, higher potential returns

c) Popular in tourist destinations

How it Works:

a) Purchase properties in high-demand areas

b) Furnish and maintain for short stays

c) List on vacation rental platforms

d) Manage guest experiences

Advantages:

a) Higher potential rental income

b) Flexibility in use

c) Property available for personal use

d) Market rate adjustability

e) Portfolio diversification

7) Wholesaling

a) Contract assignment strategy

b) No property ownership required

c) Focus on finding deals

How it Works:

a) Find undervalued properties

b) Contract with sellers

c) Assign contracts to buyers

d) Profit from assignment fee

Advantages:

a) Low capital requirement

b) No renovation needed

c) Quick turnaround

d) Market knowledge building

e) No long-term commitments

8) Commercial Real Estate

a) Business property investment

b) Larger scale operations

c) Professional tenant focus

How it Works:

a) Purchase business-use properties

b) Lease to commercial tenants

c) Manage property and tenant relations

d) Focus on long-term appreciation

Advantages:

a) Higher potential returns

b) Longer lease terms

c) Triple net lease options

d) Professional tenant relationships

e) Scale potential

9) Real Estate Crowdfunding

a) Online investment platform

b) Fractional property ownership

c) Technology-enabled investing

How it Works:

a) Join an online investment platform

b) Select specific projects

c) Invest alongside others

d) Receive proportional returns

Advantages:

a) Low minimum investment

b) Project diversity

c) Geographic flexibility

d) Professional management

e) Regular reporting

10) Lease Options

a) Rent-to-own strategy

b) Option to purchase

c) Flexibility in commitment

How it Works:

a) Secure option to purchase

b) Pay option fee upfront

c) Rent property during option period

d) Decide on purchase within timeframe

Advantages:

a) Test property before buying

b) Lock in the purchase price

c) Income during the option period

d) Lower initial investment

e) Time to arrange financing

Conclusion

We hope you have understood that Real Estate Investment provides many ways to build wealth and earn income. Whether you want to buy properties to increase in value over time, rent them out for regular income, or benefit from tax advantages, real estate can be a strong part of your investment portfolio. By learning about the types of Real Estate Investments and strategies, you can make smart choices that match your financial goals.

Learn how to sell property with our Real Estate Agent Course – Sign up now!

Frequently Asked Questions

The rules are to prioritise location, understand the market, invest for the long term, manage your budget and diversify your property types.

The basic rule is to buy low and sell high. This means purchasing property at a lower price and selling it when it increases for a profit.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Training, including the RERA Training, Investment Management Course, and Real Estate Agent Course. These courses cater to different skill levels, providing comprehensive insights into Information Security Risk Management.

Our Business Skills Blogs cover a range of topics related to Investment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Real Estate Investment knowledge, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please