We may not have the course you’re looking for. If you enquire or give us a call on +1 7204454674 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Creating a standout Risk Management Resume is crucial for professionals aiming to secure a role in this field. Risk Management covers assessing and mitigating threats to an organisation’s assets. In this blog, we discuss Risk Management, provide step-by-step guidance on crafting an effective Risk Manager Resume, and offer tips on how to highlight your MoR® certification.

Additionally, we present a sample CV template to illustrate these concepts. These insights will help you write a Risk Management Resume that captures the attention of potential employers.

Table of Contents

1) What is Risk Management?

2) How to Create a Risk Manager Resume?

3) How to add MoR® to your CV?

4) Risk Manager CV Template

5) Conclusion

What is Risk Management?

The process of finding, assessing, and eliminating the threats to an organisation’s capital and earnings is called Risk Management. These risks could stem from various sources, including financial uncertainties, legal liabilities, Strategic Management errors, accidents, and natural disasters.

Effective Risk Management ensures that an organisation can achieve its objectives while minimising potential negative impacts.

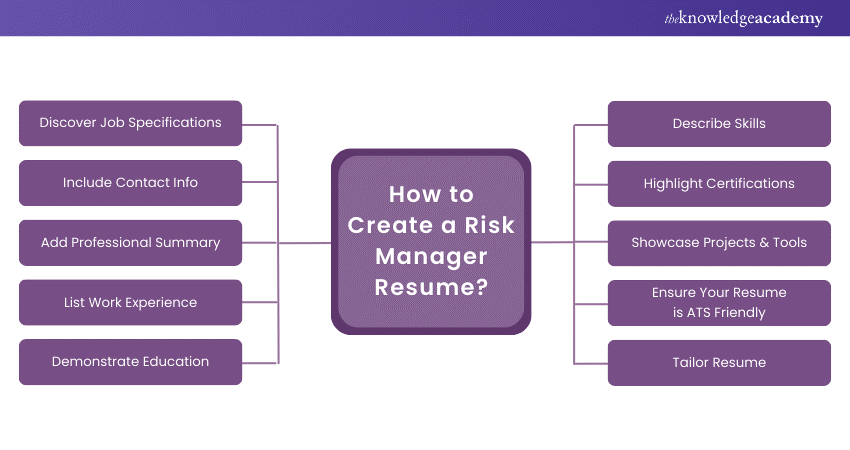

How to Create a Risk Manager Resume?

Creating a compelling Risk Manager Resume involves several key steps. Here’s a detailed guide to help you craft a resume that stands out:

a) Discover Job Specifications: Before you start writing your resume, read the job description. Understand the specific skills, qualifications, and experiences the employer is looking for. This will help you ensure the content of your CV aligns with an employer's requirements.

b) Include Contact Info: At the top of your resume, add your name, phone number, email and LinkedIn profile. Make sure this information is up-to-date and professional.

c) Add Professional Summary: Write a professional summary that highlights your key qualifications and career achievements. This section should provide a snapshot of your experience and skills, making it clear why you are a strong candidate for the role.

d) List Work Experience: Write your work experience in reverse chronological order, starting with your most recent job. For each position, include the job title, company name, location, and dates of employment. Utilise bullet points to describe your responsibilities and achievements, focusing on those that are most relevant to the Risk Management role.

e) Demonstrate Education: List your educational background, including the degrees, the institution’s name you attended, and the dates of graduation. If you have completed any relevant coursework or projects, be sure to mention them.

f) Describe Skills: Highlight the skills that are relevant to Risk Management. These might include risk assessment, Data Analysis, regulatory compliance, and Project Management. Be specific about your proficiency levels and provide instrances of when you have applied these skills in your previous roles.

g) Highlight Certifications: Certifications can significantly enhance your resume. Include any relevant certifications, such as Certified Risk Manager (CRM), Project Management Professional (PMP), or any other industry-specific credentials. Mention the certifying body and the date you received the certification.

h) Showcase Projects & Tools: If you have worked on significant projects or used specialised tools and software, include these in your resume. Describe the projects briefly and explain your role and the outcomes. Mention any tools or software you know of, such as Risk Management software, Data Analysis tools, or Project Management platforms.

i) Ensure Your Resume is ATS Friendly: Many organisations use Applicant Tracking Systems (ATS) to screen resumes. Use standard resume formats, include relevant keywords from the job description, and avoid using images or complex formatting.

j) Tailor Resume: Customise your resume for each job application. Highlight the experiences and skills that are important to the specific job you are applying for. This shows employers that you have taken the time to know their needs and are genuinely interested in the position.

Gain competence in identifying risks with our Certified Risk Management Professional CRMP – Join today!

How to add MoR® to Your CV?

Management of Risk (MoR®) is a widely recognised framework for Risk Management. If you have completed MoR® Training or Certification, include this in your resume.

Here are some steps to add a MoR® qualification to your CV:

1) Include a ‘MoR® (Level)’ Subtitle: Add this subtitle under the qualifications section of your CV.

2) List the Accredited Body: Mention the organisation that provided the MoR® Certification.

3) Enter the Certification Date: Specify the date when you obtained the certification.

Additionally, you can highlight your MoR® Certification at the top of your CV by adding it as a suffix to your name.

Enhance your knowledge of Risk Management with our Management of Risk (MoR®) Foundation Course – join today!

Risk Manager CV Template

Here’s a template of a Risk Manager CV. You can use this as a guide to craft your own CV, ensuring you highlight your skills, experience, and qualifications effectively. This example aims to help you present your professional profile in the best possible light.

|

Name: [Your Name] Location: [Your Location] Email Id: [Your Email] LinkedIn Profile: [Your LinkedIn Profile] Risk Management Professional Experience: Over [X] years Expertise: Identifying, assessing, and mitigating risks, developing Risk Management strategies, ensuring compliance with regulations, and enhancing Risk Management processes. Career Experience Senior Risk Manager • [Date] – Present [Company Name] a) Led Risk Management initiatives across the organisation, ensuring the identification and mitigation of potential risks. b) Developed comprehensive Risk Management plans, including risk assessments, control measures, and contingency plans. c) Collaborated with various departments to integrate Risk Management practices into operational processes. d) Conducted regular risk audits and provided detailed reports to Senior Management. e) Facilitated Risk Management training sessions for staff to promote a culture of risk awareness. Risk Manager • [Date] – [Date] [Company Name] a) Managed the risk assessment process, identifying potential risks and developing strategies to mitigate them. b) Utilised Risk Management software to track and analyse risk data. c) Coordinated with stakeholders to ensure compliance with Risk Management standards and regulations. d) Developed Risk Management policies and procedures. e) Monitored Risk Management performance and provided recommendations for improvements. Assistant Risk Manager • [Date] – [Date] [Company Name] a) Assisted in the development of Risk Management frameworks. b) Conducted risk assessments and provided support in the development of risk mitigation plans. c) Coordinated Risk Management activities and maintained risk registers. d) Supported senior Risk Managers in preparing risk reports and documentation. e) Monitored emerging risks and provided regular updates to the Risk Management team. Skills a) Risk Assessment b) Risk Mitigation c) Compliance Management d) Risk Analysis e) Policy Development f) Regulatory Compliance g) Risk Management Software (e.g., RSA Archer, RiskWatch) h) Data Analysis Education a) M.Sc. in Risk Management from [University Name] | [Year] b) B.Sc. in Finance from [Institute Name] | [Year] Certifications a) Certified Risk Management Professional (CRMP), Risk Management Institute (RMI), [Year] b) [Other relevant certification], [Issuing Organisation], [Year] Languages a) [Language Name 1] b) [Language Name 2] |

Conclusion

Creating an effective Risk Management Resume involves highlighting your relevant skills, experiences, and certifications. By tailoring your resume to the job specifications and ensuring it is ATS-friendly, you can increase your chances of landing your desired role. Remember to showcase your practical knowledge of Risk Management frameworks like MoR® to stand out to potential employers.

Understand how risks should be taken with our MoR® 4 Practitioner Risk Management Certification – join today!

Frequently Asked Questions

The five rules of Risk Management are: identify risks early, assess the impact and likelihood of each risk, develop strategies to mitigate or manage risks, monitor risks continuously, and communicate risk information effectively to all stakeholders.

The five key areas of risk are strategic risks (affecting long-term goals), operational risks (impacting daily operations), financial risks (related to money and investments), compliance risks (involving laws and regulations), and reputational risks (affecting public perception).

The five key areas of risk are strategic risks (affecting long-term goals), operational risks (impacting daily operations), financial risks (related to money and investments), compliance risks (involving laws and regulations), and reputational risks (affecting public perception).

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various MoR® Management of Risk, including the MoR® 4 Practitioner Risk Management Certification, Management of Risk (MoR®) Foundation Course, and Certified Risk Management Professional CRMP Course. These courses cater to different skill levels, providing comprehensive insights into MoR® Benefits.

Our Project Management Blogs cover a range of topics related to Risk Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Risk Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Project Management Resources Batches & Dates

Date

MoR® 4 Practitioner Risk Management Certification

MoR® 4 Practitioner Risk Management Certification

Mon 13th Jan 2025

Mon 10th Mar 2025

Mon 12th May 2025

Mon 14th Jul 2025

Mon 15th Sep 2025

Mon 10th Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please