We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In today's competitive job market, obtaining the necessary qualifications can significantly enhance your career prospects. One such qualification in the financial industry is the Certificate in Mortgage Advice and Practice (CeMAP) Exam. The exam can be difficult, but with the right CeMAP Exam Tips, strategies and preparation, you can increase your chances of success.

This blog provides valuable CeMAP Exam Tips to help you pass confidently and pave the way for a rewarding career in the Mortgage industry. These tips aim to enhance your preparation and increase your chances of success in obtaining this qualification.

Table of Contents

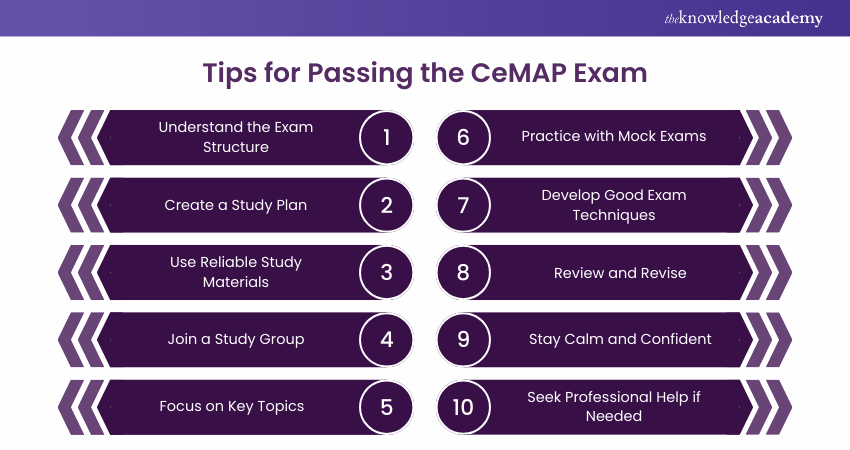

1) Tips and Tricks for Passing the CeMAP Exam

a) Understand the Exam Structure

b) Create a Study Plan

c) Use Reliable Study Materials

d) Join a Study Group

e) Focus on Key Topics

f) Practice with Mock Exams

g) Develop Good Exam Techniques

h) Review and Revise

i) Stay Calm and Confident

j) Seek Professional Help if Needed

2) Conclusion

Tips and Tricks for Passing the CeMAP Exam

The CeMAP is a crucial qualification for those looking to pursue a career in Mortgage Advice in the UK. With the right approach, you can confidently prepare for and pass this exam. Here are some practical tips and tricks to help you succeed.

1) Understand the Exam Structure

The CeMAP Exam consists of three modules:

a) CeMAP 1: UK Financial Regulation

b) CeMAP 2: Mortgages

c) CeMAP 3: Assessment of Mortgage Advice Knowledge

Each module requires a solid understanding of different aspects of the Mortgage industry. Familiarise yourself with the syllabus and the types of questions asked in each module.

2) Create a Study Plan

A well-structured study plan is essential for preparation. Allocate sufficient time for different modules based on your strengths and weaknesses. Break down the syllabus into manageable sections and set daily or weekly study goals. Consistency is important, so make sure to follow your study plan.

3) Use Reliable Study Materials

Invest in quality materials such as textbooks, online courses, and revision guides. The London Institute of Banking & Finance (LIBF) offeres official study resources that are highly recommended. Additionally, consider using practice questions and mock exams to test your knowledge and find areas that need improvement.

4) Join a Study Group

Studying with others can be highly beneficial. Join a group or online forum where you can discuss topics, share resources, and get support from fellow candidates. Explaining concepts to others can also help strengthen your understanding.

Learn how to analyse financial statements with our Financial Management Course – Join today!

5) Focus on Key Topics

Certain topics are more heavily weighted in the exam. Pay extra attention to these areas:

a) UK financial regulations and their application

b) Types of Mortgage products and their features

c) The Mortgage application process

d) Legal considerations in Mortgage lending

e) Customer needs and financial circumstances

Prioritise these topics in your study plan to ensure you have a strong grasp of the most important concepts.

6) Practice with Mock Exams

These exams are a valuable tool for CeMAP Exam preparation. They simulate the actual exam environment, helping you get used to the format and timing. Aim to complete several mock exams under timed conditions. Review your answers thoroughly to understand your mistakes and learn from them.

7) Develop Good Exam Techniques

On exam day, effective techniques can make a big difference. Here are some tips:

a) Read each question carefully and ensure you understand what is being asked before answering.

b) Manage your time wisely, ensuring you allocate enough time for each question and avoid spending too long on any one question.

c) If you're unsure about an answer, make a guess and move on. You can always come back to it later if time permits.

d) Use the process of elimination to narrow down your choices on multiple-choice questions.

8) Review and Revise

Regular revision is key to retaining information. Set aside time each week to review what you've learned. Summarise key points in your own words, create flashcards for quick revision, and test yourself frequently. Revisiting topics multiple times will help reinforce your knowledge and boost your confidence.

9) Stay Calm and Confident

It's natural to feel nervous before an exam, but try to stay calm and confident. Take regular breaks to avoid burnout, exercise regularly, and eat a balanced diet. Practising techniques such as deep breathing or meditation can also help minimise stress and improve concentration. Come to the exam centre early to avoid any last-minute stress.

10) Seek Professional Help if Needed

If you're struggling with certain topics or need additional support, consider seeking help from a professional tutor. Tutors can provide personalised guidance, clarify complex concepts, and offer targeted practice exercises to strengthen your understanding.

Conclusion

Passing the CeMAP Exam is an achievable goal with the right approach and dedication. By understanding the exam structure, creating a solid study plan, using reliable materials, and practising regularly, you can build the knowledge needed to succeed. Remember to stay calm, take care of yourself, and seek help if needed. With these CeMAP Exam Tips, you'll be well on your way to a rewarding career in Mortgage Advice. Good luck!

Improve your understanding of Mortgage Advice and Practice with our CeMAP Course (Level 1,2 And 3) - Join today!

Frequently Asked Questions

Many candidates find CeMAP to be the hardest because it covers a wide range of UK financial regulations, which can be complex and detailed. It requires a deep understanding of various laws and guidelines. However, with thorough preparation, it is manageable.

You can complete the CeMAP qualification in as little as six months with dedicated study. However, the timeline varies depending on your personal schedule and study pace. Some people might take longer, up to a year, to ensure they fully grasp the material.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 And 3), Financial Management Course, and Diploma for Financial Advisers DipFA. These courses cater to different skill levels, providing comprehensive insights into Financial Analyst.

Our Business Skills Blogs cover a range of topics related to Mortgages, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage knowledge, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 10th Feb 2025

Mon 12th May 2025

Mon 7th Jul 2025

Mon 15th Sep 2025

Mon 3rd Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please