We may not have the course you’re looking for. If you enquire or give us a call on +27 800 780004 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In the Finance industry, businesses and organisations rely on professionals who possess a unique set of skills to maintain their financial health. So, candidates looking to attend the interview for a Bookkeeper’s role must first go through the Bookkeeper Job Description.

Bookkeepers are professionals who help organisations ensure full compliance with regulations and generally important financial reports. These facets make Bookkeepers a necessity for a business's financial stability.

Thus, it becomes crucial to learn about all the skills that companies look for in a Bookkeeper. So, read this blog to explore the Bookkeeper Job Description and what skills and qualifications do businesses look for in a Bookkeeper. Let's delve in to learn more!

Table of Contents

1) Who is a Bookkeeper?

2) Responsibilities of a Bookkeeper

3) Qualifications of a Bookkeeper

4) What are the skills of a Bookkeeper?

5) Sample Bookkeeper Job Description

6) Salary range for Bookkeepers

7) Conclusion

Who is a Bookkeeper?

A Bookkeeper is a financial professional who is tasked with maintaining and organising an organisation's financial records. Their primary role is to ensure that all financial transactions, including expenses, revenues, and other financial activities, are accurately recorded and classified. Bookkeepers are vital in helping businesses and organisations maintain their financial health and comply with accounting standards and regulations.

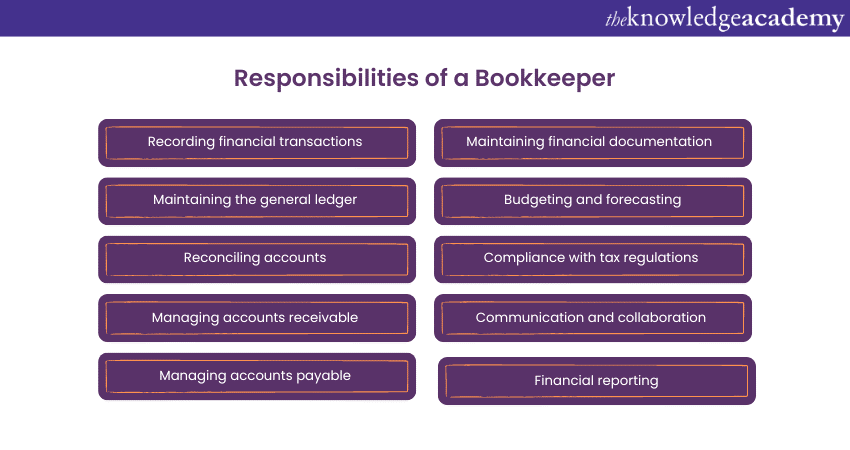

Responsibilities of a Bookkeeper

The responsibilities of a Bookkeeper typically include the following:

1) Recording financial transactions: Bookkeepers record financial transactions in the company's accounting software or ledger. This includes logging income, expenses, purchases, sales, and other financial activities.

2) Maintaining the general ledger: They maintain the general ledger, which is a detailed record of all financial transactions. This ledger serves as the foundation for financial statements and reporting.

3) Reconciling accounts: Bookkeepers reconcile bank statements and other financial accounts to ensure that the recorded transactions match the actual financial activity. This process helps identify discrepancies or errors.

4) Managing accounts receivable: Bookkeepers track and manage accounts receivable, which involves monitoring outstanding invoices, following up on overdue payments, and recording payments received.

5) Managing accounts payable: They also manage accounts payable, which includes tracking and organising bills. Thus, they ensure timely payments and maintain good relationships with vendors.

6) Financial reporting: Bookkeepers are also responsible for generating various financial reports, including income statements, balance sheets, and cash flow statements, which provide an idea of the company's financial health.

7) Maintaining financial documentation: They organise and maintain financial documentation, ensuring that records are accurate, up-to-date, and easily accessible for audits or reference.

8) Budgeting and forecasting: Some Bookkeepers assist in creating budgets and forecasts, helping businesses plan and manage their financial resources effectively.

9) Compliance with tax regulations: Bookkeepers help ensure the company complies with tax regulations by recording and reporting income, expenses, and deductions accurately.

10) Communication and collaboration: They often work closely with accountants, auditors, and other financial professionals to provide them with accurate and organised financial data.

Ready to kickstart your career in Bookkeeping? Join our Book Keeping Training and become a skilled financial professional today!

Qualifications of a Bookkeeper

The qualifications necessary to be eligible for the post of a Bookkeeper can differ depending on the organisation’s requirements. Here is a basic list of qualifications that the employers will want to include in their Bookkeeper Job Description:

a) Bachelor’s degree in Accounting, Finance or other related disciplines

b) A qualified Certified Public Accountant

c) Any prior experience in Bookkeeping

d) Any experience working in a high-pressure and fast-paced environment

e) Certifications in Accounting or Business Administration will be a plus

What are the skills of a Bookkeeper?

Bookkeepers require a specific set of skills to perform their job effectively. Here are some key skills and qualities commonly associated with a successful Bookkeeper:

1) Attention to detail: Bookkeepers need to be meticulous and accurate when recording financial transactions to prevent errors and discrepancies.

2) Mathematical proficiency: Strong math skills are essential for performing calculations, reconciling accounts, and ensuring the accuracy of financial data.

3) Organisational skills: Bookkeepers must be highly organised to maintain well-structured financial records and efficiently manage various documents and data.

4) Time management: Efficient and effective time management is crucial to prioritise tasks and meet deadlines for financial reporting, bill payments, and other responsibilities.

5) Analytical thinking: Bookkeepers should have the ability to analyse financial data, detect anomalies, and troubleshoot discrepancies.

6) Computer literacy: Proficiency in accounting software and spreadsheet programs, such as QuickBooks and Microsoft Excel, is important for data entry, reporting, and analysis.

7) Communication skills: Bookkeepers may need to interact with colleagues, vendors, and financial professionals, so strong verbal and written communication skills are valuable.

8) Ethical conduct: Bookkeepers handle sensitive financial information, and ethical behaviour is essential to maintain the trust and confidentiality of financial data.

Sample Bookkeeper Job Description

Here is an example of a job description for a Bookkeeper in the UK:

Job details

Here’s how the job details align with your job preferences.

Manage job preferences at any time in your profile.

Pay

£30,000 - £35,000 a year

Job type

Full-time

Benefits

Pulled from the full job description

Cycle to work scheme

Private medical insurance

Sabbatical

Full job description

Description

What you’ll get:

At Perlego we believe in the key role you will play to achieve our shared mission. You'll belong to a culture of dreamers, team players and avid learners with a flexible, value-based approach. Here, you can become your best self, and through your talent, make a real impact in the world of education.

The numbers speak for themselves:

94 per cent of people you’ll work with are inspired by the purpose and mission of Perlego

88 per cent of people you’ll work with feel they belong at Perlego

90 per cent of people you’ll work with would recommend us as a great place to work

Stats from our latest anonymous employee engagement survey

What we do:

At Perlego, there are over 120 of us working hard to make education accessible to all. We believe access to good quality affordable learning unlocks potential. Knowledge should be more accessible, not locked behind sky-high price tags.

Last year, we expanded our library to make over 1 million books affordable for learners, earned a 100% Gold ASPIRE rating for accessibility and reached over 15 million people. The next stage of Perlego is twofold: 1) expand our support to students and publishers globally, and 2) build a product that goes beyond the book, a platform that helps students study smarter and educators teach more effectively.

What you'll do:

Full ownership of accounts payable - Ultimately be responsible for managing the accounts payable process from invoice processing, approval and preparation of payments runs

Monthly VAT preparation including reviewing transactions to identify VAT-relevant items and ensure proper treatment.

Responsible for accurate and timely journal posting to maintain up-to-date financial records and support the preparation of financial statements.

Multi-currency bank reconciliation - Process payments and receipts in the accounting system and complete bank and credit card reconciliations

Full ownership of accounts receivable - Liaising with the sales team on Sales Order Form details, credit control, raising invoices and credit notes

Ensuring accurate and timely payment allocations to relevant accounts for effective financial reconciliation

Supporting the Financial Controller with ad-hoc duties

Preparation of reconciliations and workbooks for month end tasks

Requirements

Essential skills

Hands-on experience working in Accounts Receivable & Accounts Payable

Qualified by experience or actively studying towards a professional qualification

Knowledge of UK financial regulations and bookkeeping practices

Comfortable using accounting software such as Xero and Spendesk or similar and highly competent in use of productivity tools like Google Drive and Sheets.

Strong attention to detail with an ability to spot numerical errors

Good time management skills and ability to prioritise work

Effective communication skills, both verbal and written

Comfortable working independently

Nice to have:

Background working in a SaaS business

Capable of working with VAT, EU VAT and USA sales tax

Perlego has a hybrid working environment, however if you can come into our London office once a week, this would be ideal.

Benefits

Benefits include:

Compensation

The range available for this role is £30,000 to £35,000.

We are willing to offer a lot of flexibility in how you structure your time, whether that means support for study (if required) or pro-rated/part time work.

Why should you work at Perlego?

Apart from our mission, we foster a unique company culture championing self-empowerment, personal development, direct communication and mutual support. We’re proud of our Glassdoor reviews and the fact that 97% of our team would recommend Perlego as a place to work.

Want to learn more about how we’re making learning accessible? Check out our latest impact report

Flexible

We're making learning accessible to all and we want our ways of working to be accessible too. We spend our time between our impressive office in Chancery Lane, and a bit of home working. Work in a way that supports your needs and your life. We trust people to know what works best for them.

We are flexible if you wish to work remotely overseas for short periods of time, as long as you remain a UK tax resident

L&D budget

We value continuous learning; you will get £500 per year to spend on the training of your choice

Unlimited coaching opportunities

Unlimited access to MoreHappi, an on-demand professional coaching platform to offer all employees access to unbiased and professional coaching opportunities.

Learning time

All employees have dedicated Learning Time to focus on new skills, projects or interests that lay outside of their day-to-day job

Work-life balance

Everyone needs a break, so enjoy 30 days off (incl. bank holidays) + 1 additional day annual leave for every year of service up to 35 days off (incl. bank holidays)

Flexi bank holidays

We understand that not everyone aligns with the same calendar; we offer the flexibility to take your local country's bank holiday allowance for other religious or cultural days.

e.g. switch UK Easter Bank Holidays Days for Eid celebrations

Office reset

All employees can also enjoy the days between Boxing Day and New Year off, to reset and refresh for the new year - this is additional to your annual leave

Sabbatical

After three years there is an opportunity to take a 1-month unpaid sabbatical, and after five years there is an opportunity to take a 1-month paid sabbatical

Personal days

Life happens and we want you to be able to use your annual leave for resting, relaxing or taking time out to do something you love!

We offer 1 additional day a year for life events (your wedding, relocation, moving house, or a child starting school).

Health & wellbeing

We want everyone to feel healthy and happy, so you get the choice of a wellbeing subsidy or private medical insurance via Vitality.

Mental health

All employees also get access to a free counselling support service via Spill

Financial wellbeing

Track your financial goals and receive financial advice all via Mintago

Cycle to work Scheme

We're committed to building a sustainable business, so we encourage cycling to work. Perlego will buy your bike of choice, which you'll pay back over 12 months.

Social

We're a tight-knit bunch who enjoy our time to play. We have regular social events and activities for everyone - everything from white water rafting to board game nights.

Family time

We believe family is really important; we offer new parents a competitive matched parental leave as well as a phased return to work from extended leave.

Workplace nursery benefit

We want to support working parents and carers, so we offer a workplace nursery benefit scheme, helping our employees potentially save thousands of £££ against the cost of nurseries each year.

Belonging at Perlego:

We are an equal opportunity employer and value diversity of thought and background.

We are actively building a diverse team, so we strongly encourage applications from people of colour, the LGBTQ+ community, people with disabilities, neurodivergent people, parents, carers, and people from lower socio-economic backgrounds.

To enable an equitable experience for all and give you the best chance of success, if you have any specific requirements for any stage of the interview process, please let us know by emailing [email protected]

Register for our Introduction To Credit Control Course to master the art of managing credit and boosting financial stability!

Salary range for Bookkeepers

The salary range for Bookkeepers can vary based on several factors such as location, experience, education, and industry. Here is a general overview of the salary range for Bookkeepers in the United Kingdom:

1) Entry-Level Bookkeepers: Entry-level Bookkeepers in the UK can expect to earn an annual salary ranging from £18,000 to £25,000.

2) Experienced Bookkeepers: Bookkeepers with a few years of experience can earn a higher annual salary, typically in the range of £25,000 to £35,000 or more, depending on their expertise and the complexity of their role.

3) Certified Bookkeepers: Bookkeepers who hold professional certifications, such as the Association of Accounting Technicians (AAT) qualification, may command higher salaries. Their annual earnings can range from £30,000 to £45,000 or higher.

Take control of your financial future! Join our Financial Management Training now!

Conclusion

In this blog, we've explored the vital role of a Bookkeeper and provided a step-by-step understanding of the Bookkeeper Job Description. Whether you're an employer looking to hire a Bookkeeper or an aspiring Bookkeeper aiming to understand the role better, we've covered the essential aspects of this profession.

Join our Accounting & Finance Training and enhance your expertise for a brighter financial future!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Book Keeping Course

Book Keeping Course

Fri 7th Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 1st Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please