We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

With the creation of Bitcoin, Cryptocurrencies carved out a niche for themselves in the digital revolution. Consider this as a transformative innovation that challenges traditional monetary systems and opens a new realm of global commerce possibilities. Given this circumstance, the Future of Cryptocurrency beckons with promises of a transformed financial landscape.

But ever wondered what does this future hold? Will cryptocurrencies upend traditional banking, or will they be integrated into the very fabric of the existing financial systems? This comprehensive blog delves into the heart of the matter, exploring the potential and the challenges that lie ahead.

With the Future of Cryptocurrency unfolding before you, and the Compound Annual Growth Rate of the market assumed to grow at 12.5% by 2030, it’s time to confirm if you are ready for the upcoming changes. So, let’s dive into this blog to gain insights and analyses into the Cryptocurrency prospects.

Table of Contents

1) Introduction to Cryptocurrency

2) Crypto Market Predictions

3) Why Cryptocurrency Could be the Future of Money?

4) Regulatory Factors Affecting the Future of Cryptocurrency

5) Potential Risks and Challenges

Introduction to Cryptocurrency

Cryptocurrency marks a pivotal shift in finance as a digital currency secured by cryptography, making it virtually tamper-proof. Operating on decentralised Blockchain networks, it stands apart from government-issued currencies. Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, spearheaded this digital currency revolution as the foremost and most recognised Cryptocurrency.

The advent of Bitcoin gave rise to a multitude of other Cryptocurrencies, each with unique features and purposes, enabling swift peer-to-peer transactions sans traditional banking intermediaries, thus cutting down on time and costs. These digital currencies are underpinned by smart contracts—self-executing contracts with the terms directly written into code.

Despite offering financial innovation and broader inclusion, Cryptocurrencies face challenges in regulation, market stability, and consumer protection, continuing to mould the financial landscape as they evolve.

Crypto Market Predictions

From mainstream recognition to increased security measures, the future looks extremely promising for the Crypto market. Let's explore some interesting Cryptocurrency Trends and predictions that will shape the Future of Cryptocurrency:

Bitcoin Predictions

According to the data from TradingView and Coinbase, Bitcoin reached an All-Time High (ATH) of 51,000 GBP in November 2021. However, it suffered a major crash in November 2022, dropping to as low as 13,076.66 GBP. Since then, it has recovered from the slump and shocked many Analysts and sceptics alike. It is currently on an upward trend that could potentially reach and surpass its previous peak.

Some Analysts expect Bitcoin to break new records in the near future as more institutional investors enter the market and regulatory clarity improves.

Transform your finances with our expert Stock Trading Course – secure your spot now!

Mass Adoption and Mainstream Recognition

Cryptocurrencies gained significant momentum in 2023 as major financial institutions adopted digital assets and paved the way for the future to witness a surge in mass adoption. With more clarity and consistency in regulations across different regions, more traditional investors are likely to join the market. As the negative perception of Cryptocurrencies fades away, we can expect a wider acceptance of digital assets in everyday transactions, leading to their integration into global financial systems.

Major organisations like Tesla and PayPal have already integrated Cryptos into their businesses, which may pave the way for others.

Interoperability and Cross-chain Solutions

Blockchain interoperability will be a key focus in the near future as the Crypto space evolves into a more interconnected ecosystem. Cross-chain solutions and interoperability protocols will enable smooth communication and asset transfer between different Blockchain networks. Projects that aim to connect diverse Blockchains will gain popularity, fostering collaboration and innovation across the decentralised landscape.

Enhanced Security Measures

As the Crypto industry grows, so do the challenges of cyber security. In 2024, we can anticipate a stronger emphasis on security measures within the Crypto space. Blockchain projects and exchanges will invest in solid security infrastructure, using advanced encryption techniques and decentralised storage solutions to protect user assets. The industry’s dedication to enhancing security will be essential in developing trust and confidence among users, both institutional and retail.

Decentralised Finance (DeFi) Maturation

The Decentralised Finance (DeFi) space has been a source of innovation, offering a variety of financial services without the need for traditional intermediaries. In the future, we can foresee the DeFi ecosystem maturing further, addressing challenges related to security, scalability, and user experience.

Improved infrastructure and interoperability among different DeFi platforms will create a more resilient and user-friendly decentralised financial landscape. As DeFi becomes more accessible, traditional financial institutions might have to adapt or risk becoming obsolete.

Why Cryptocurrency Could be the Future of Money?

One optimistic scenario in the upcoming future is that regulators around the world could agree on a global framework for Crypto regulation. Although this seems improbable today, it may come to fruition in the distant future. Different countries have different views on Crypto, ranging from legalising Bitcoin as an official currency in countries like El Salvador and the Central African Republic (CAR) to banning Crypto transactions in China. Therefore, a global consensus on the issue is unlikely to be reached in the near term.

A Federal Opportunity

Even though there's no worldwide consensus on Crypto regulations, progress is being made in the US at the federal level. The Biden administration has put together an expert team to guide the regulation of Cryptocurrencies, with US Treasury Secretary Janet Yellen and Securities and Exchange Commission (SEC) Chairman Gary Gensler at the helm. Yellen has long monitored the sector, albeit occasionally with scepticism.

Gensler, on the other hand, has an educational background in the field, having taught about Bitcoin, Blockchains, and various Cryptocurrency subjects at MIT in 2018.

With such knowledgeable people shaping future regulations, there is hope that a feasible system can be established for investors, consumers, Cryptocurrency businesses, and traditional banks. Well-informed regulators will comprehend critical and relevant issues, such as the distinctions between a value storage system like Bitcoin and a sophisticated ledger with smart contracts like Ethereum.

The US Congress introduced a few Crypto regulation bills in the first half of 2022. However, the bureaucratic process is slow, and this issue requires some thorough thinking and careful analysis.

Elevate your trading game and secure your financial success – join our Investment and Trading Training and unlock the secrets!

A Consumer-driven Trend

As governmental entities devise a legal framework and taxation system, Cryptocurrencies could become more prevalent in the digital wallets of US consumers. Bitcoin became a legal tender in a few countries; the US could do the same anytime soon.

Many retailers are likely to begin accepting payments in the form of Cryptocurrencies like Bitcoin, Litecoin, and Dogecoin. Increased use of Crypto should motivate regulatory agencies and politicians to act faster, and the Blockchain systems should also benefit from widespread usage.

Future Outlook

Investors dislike uncertainty, so even a very strict regulatory framework is likely to be a huge improvement over the lack of any regulation. Once legal regulations are established, we can expect the Crypto market to reach new levels.

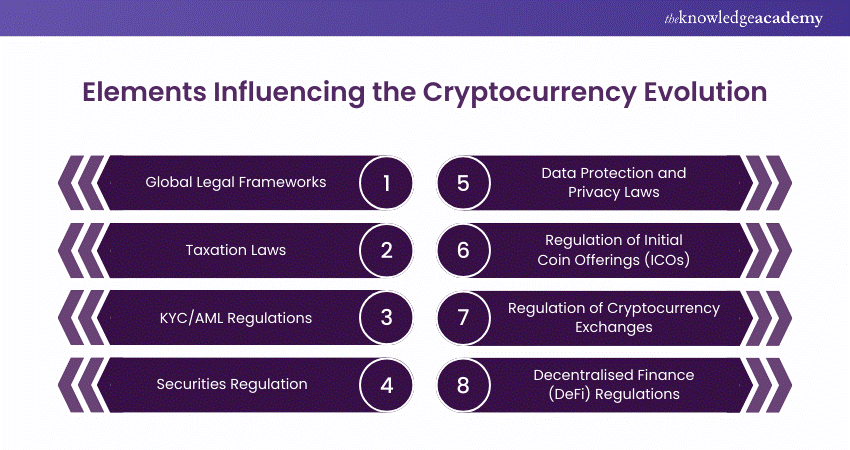

Regulatory Factors Affecting the Future of Cryptocurrency

Crypto is also affected by the regulatory factors. You will learn about some of these factors in this section.

1) Global Legal Frameworks: The lack of a global legal framework for Cryptocurrencies makes it difficult for consistent regulation. Different countries have different rules, leading to uncertainty for investors and businesses.

2) Taxation Laws: How countries decide to tax Cryptocurrencies can significantly impact their use and growth. High tax rates may discourage people from using Cryptocurrencies, while low rates could encourage growth.

3) KYC/AML Regulations: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations may become stricter to prevent illegal activities using Cryptocurrencies.

4) Securities Regulation: Some countries may classify certain Cryptocurrencies as securities. This would make them subject to specific regulatory guidelines. This classification could influence how these Cryptocurrencies are traded and used.

5) Data Protection and Privacy Laws: As Cryptocurrencies rely on the Blockchain, which records transactions, they could be affected by data protection and privacy laws. These laws can impact how transaction data is stored and used.

6) Regulation of Initial Coin Offerings (ICOs): ICOs are a common method of fundraising for new Cryptocurrencies. These regulations may impact how these offerings are conducted. This could affect the introduction of new Cryptocurrencies.

7) Consumer Protection: Governments are concerned about protecting consumers from potential scams and volatility in the Crypto market. Therefore, they may introduce regulations to safeguard the interests of consumers.

8) Regulation of Cryptocurrency Exchanges: Governments may decide to regulate Cryptocurrency exchanges more strictly to ensure they follow financial laws and provide adequate security to protect users' investments.

9) Decentralised Finance (DeFi) Regulations: DeFi is disrupting traditional financial services, and regulators may step in to control these services to protect consumers. This will also maintain the stability of the financial system.

10) Cryptocurrency Mining Regulations: Given the environmental impact of Crypto mining, some Governments might regulate it to ensure it adheres to environmental and energy usage laws. This could impact the production of Cryptocurrencies, especially proof-of-work ones like Bitcoin.

Dive into the dynamic world of Forex trading with our Foreign Exchange Training today!

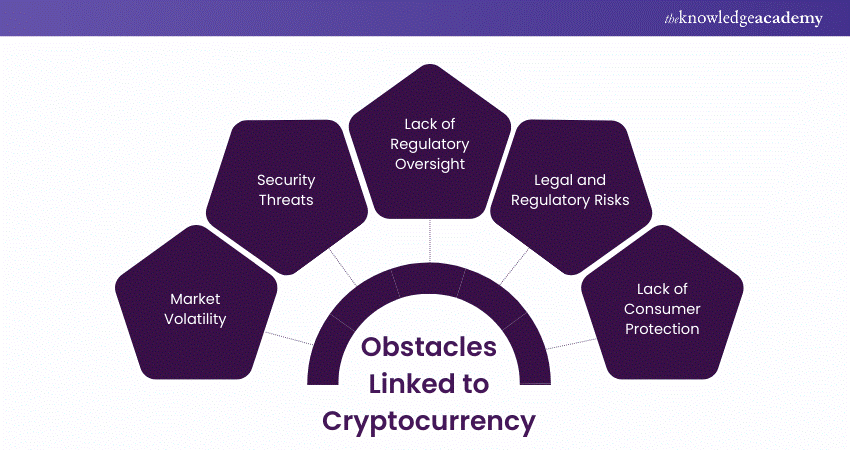

Potential Risks and Challenges

Just like every other financial instrument out there in the market, Cryptocurrencies face potential risks and challenges. Let’s take a look at them:

1) Cryptocurrencies are infamous for their price volatility. Rapid fluctuations can lead to significant losses for investors who are not prepared to manage these risks.

2) Despite the secure nature of Blockchain, Cryptocurrencies are not immune to cyber threats. Hacking of wallets and exchanges can lead to significant losses.

3) The absence of a central authority can pose risks such as fraud or market manipulation. Scams and Ponzi schemes are not unheard of in the Cryptocurrency world.

4) Unfavourable regulations or outright bans in certain jurisdictions can negatively impact the value and acceptance of Cryptocurrencies.

5) When there has been fraud or theft, users often have limited recourse compared to traditional banking systems.

Join our comprehensive Day Trading Course and unlock your full trading potential – join us now!

Conclusion

The Future of Cryptocurrency is a blend of promise and uncertainty. It is also fuelled by innovative technologies, regulatory challenges, and shifting market dynamics. As we navigate this complex landscape, it's clear that Cryptocurrencies hold the potential to redefine financial systems and offer unprecedented opportunities for global economic participation.

Frequently Asked Questions

The Cryptocurrency industry offers diverse career opportunities, including roles in Blockchain development, Cryptocurrency trading and analysis, legal and regulatory compliance, marketing and community management, and financial services focused on digital assets.

While understanding Blockchain Technology is advantageous, it's not mandatory for all roles in the Cryptocurrency sector. Positions in marketing, sales, or administrative support may not require deep technical knowledge, though a basic understanding of Blockchain can be beneficial.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. By tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Courses, including Cryptocurrency Trading Training, Stock Trading Training, and Day Trading Course. These courses cater to different skill levels, providing comprehensive insights into Investment methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills blogs to discover more insights!

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please