We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Credit Control is a vital aspect of managing a business. It involves the policies and procedures that ensure the timely collection of payments from customers and the prevention of bad debts. What is Credit Control, you may ask? It is the process of monitoring and regulating the credit extended to customers by a business. In this blog, we will explain what Credit Control is, what its objectives and factors are, what the methods of Credit Control are, and what the primary responsibilities of a Credit Controller are.

Table of Content

1) Understanding “What is Credit Control?”

2) Objectives of Credit Control

3) Factors influencing Credit Control

4) Credit Control methods

5) Primary responsibilities of a Credit Controller

6) Conclusion

What is Credit Control?

Credit Control is the process of monitoring and regulating the amount of credit extended by a business to its customers or suppliers. Credit Control aims to ensure that the business does not face cash flow problems due to delayed or defaulted payments and that the business maintains a healthy balance between sales and receivables.

Credit Control involves setting credit policies and terms, assessing the creditworthiness and risk of potential customers or suppliers, granting or denying credit requests, enforcing payment deadlines and penalties, collecting overdue payments, and taking legal action if necessary.

Objectives of Credit Control

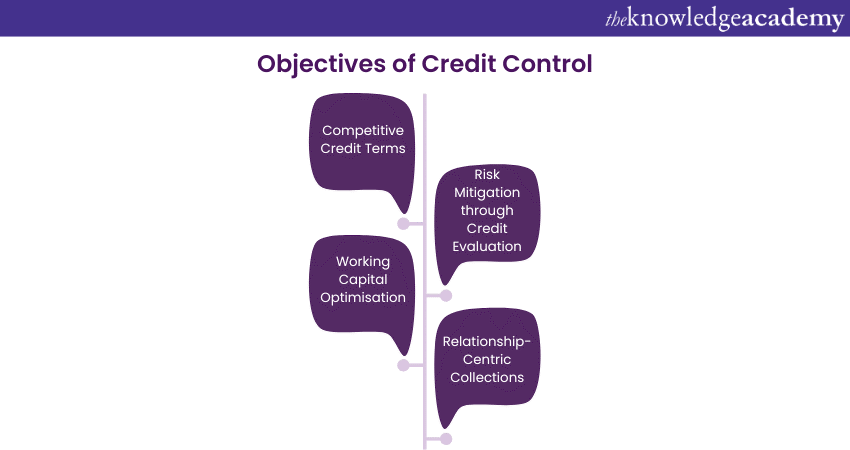

The main objectives of Credit Control are:

a) To increase sales and revenue by offering competitive and flexible credit terms to customers or suppliers.

b) To minimise the risk of bad debts and write-offs by screening and evaluating the creditworthiness and payment history of customers or suppliers.

c) To optimise the working capital and cash flow of the business by ensuring timely and consistent collection of payments from customers or suppliers.

d) To maintain good customer or supplier relationships by providing clear and transparent communication, resolving disputes, and offering incentives or discounts for prompt payments.

Elevate your financial acumen and strategic decision-making with our Financial Management Course – explore the path to financial excellence.

Factors Influencing Credit Control

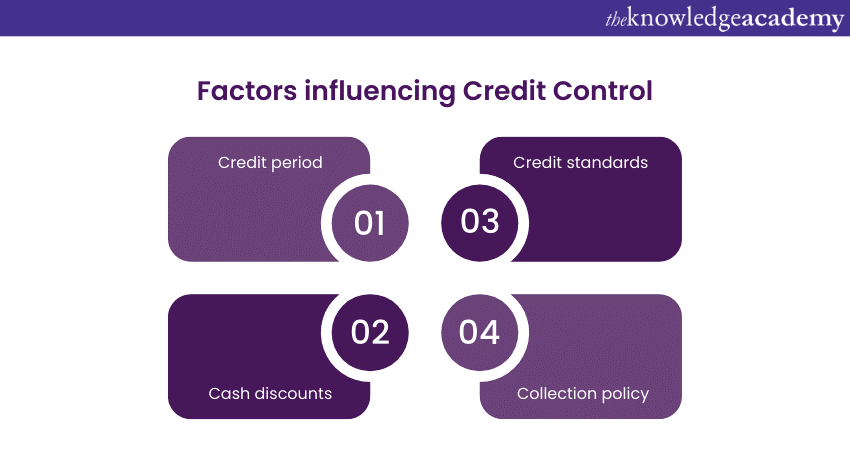

There are several factors that influence the Credit Control policy and strategy of a business, such as:

Credit period

The credit period is the length of time that a customer or supplier is allowed to pay for the goods or services purchased on credit. The credit period can vary depending on the industry, the market conditions, the nature of the product or service, the competition, and the customer or supplier profile. Generally, a longer credit period can attract more customers or suppliers, but it can also increase the risk of delayed or defaulted payments and reduce the cash flow of the business.

Cash discounts

Cash discounts are the reductions in the invoice amount that a customer or supplier can receive if they pay within a specified period of time, usually shorter than the credit period. Cash discounts can encourage early payments, improve cash flow, and reduce the cost of financing. However, cash discounts can also reduce the profit margin of the business and may not be effective if the customer or supplier has a low sensitivity to price or a high opportunity cost of capital.

Credit standards

Credit standards are the criteria that a business uses to determine the creditworthiness and risk of a customer or supplier. Credit standards can include financial statements, credit reports, credit scores, references, guarantees, collateral, and other relevant information. Credit standards can help the business select the customers or suppliers that are most likely to pay on time and in full and avoid those that are likely to default or delay payments. However, credit standards can also limit the sales potential of the business and may require additional resources and costs to obtain and analyse the data.

Collection policy

Collection policy is the set of rules and procedures that a business follows to collect payments from the customers or suppliers that have purchased on credit. Collection policy can include sending invoices and reminders, making phone calls and visits, negotiating payment plans, imposing late fees and interest charges, withholding deliveries or services, and taking legal action. A collection policy can help the business recover the payments that are due or overdue and reduce bad debts and write-offs. However, collection policy can also affect customer or supplier satisfaction and loyalty and may involve additional expenses and time.

Enrich your career in payroll management – seize the opportunity to excel with our Payroll Course.

Credit Control methods

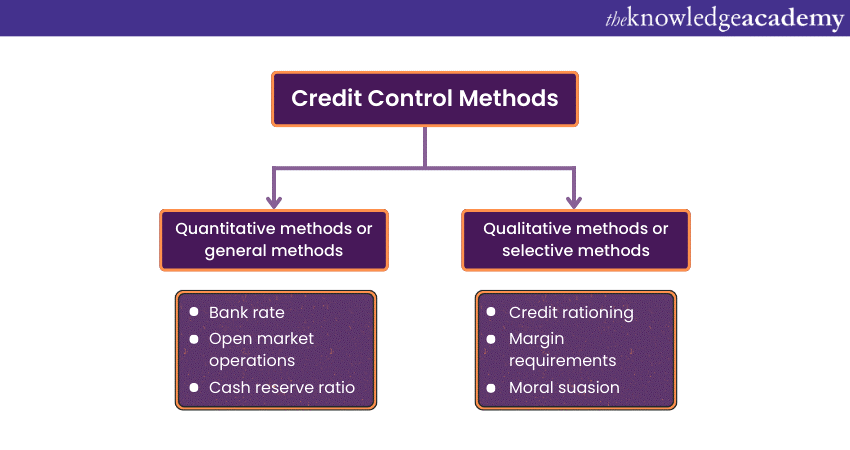

There are two main types of Credit Control methods, quantitative methods and qualitative methods. This section of the blog will shed light on both methods:

Quantitative methods or general methods

Quantitative methods are the Credit Control methods that affect the overall availability and cost of credit in the economy. Quantitative methods are usually implemented by the central bank or the monetary authority and aim to regulate the money supply and interest rates. Some examples of quantitative methods are:

a) Bank rate: The bank rate is the interest rate that the central bank charges the commercial banks for lending or borrowing money. A higher bank rate can discourage commercial banks from borrowing money from the central bank and encourage them to lend money to the public at higher interest rates. This can reduce the demand and supply of credit in the economy and vice versa.

b) Open market operations: Open market operations are the buying and selling of government securities by the central bank in the open market. When the central bank buys government securities from commercial banks, it increases the money supply and the liquidity of the commercial banks and lowers the interest rates. This can increase the demand and supply of credit in the economy and vice versa.

c) Cash reserve ratio: The cash reserve ratio is the percentage of deposits that the commercial banks are required to keep as reserves with the central bank. A higher cash reserve ratio can reduce the amount of money that commercial banks can lend to the public and increase the interest rates. This can reduce the demand and supply of credit in the economy and vice versa.

Qualitative methods or selective methods

Qualitative methods are the Credit Control methods that affect the specific sectors or purposes of credit in the economy. Qualitative methods are usually implemented by the government or regulatory bodies and aim to direct the credit flow towards the desired or priority areas and away from the undesired or non-priority areas. Some examples of qualitative methods are:

a) Margin requirements: Margin requirements are the minimum percentage of the value of a security that a borrower has to deposit as collateral with the lender. A higher margin requirement can reduce the amount of credit that a borrower can obtain by pledging security and discouraging speculative or risky borrowing. This can reduce the demand and supply of credit for certain securities and vice versa.

b) Credit rationing: Credit rationing is the restriction of the amount of credit that a lender can grant to a borrower, regardless of the interest rate or the collateral. Credit rationing can be used to limit the credit availability for certain sectors or purposes, such as agriculture, exports, housing, or consumer goods, and to allocate the credit according to the social or economic objectives of the government or the regulator.

c) Moral suasion: Moral suasion is the persuasion or request by the government or the regulator to the lenders or the borrowers to follow a certain credit policy or behaviour without any legal or monetary compulsion. Moral suasion can be used to influence the credit decisions of the lenders or the borrowers, such as the interest rates, the credit terms, the credit standards, or the credit purposes, in accordance with the desired or expected outcomes of the government or the regulator.

Transform your financial skills with our Accounting and Finance Training – empower your career journey now!

Primary responsibilities of a Credit Controller

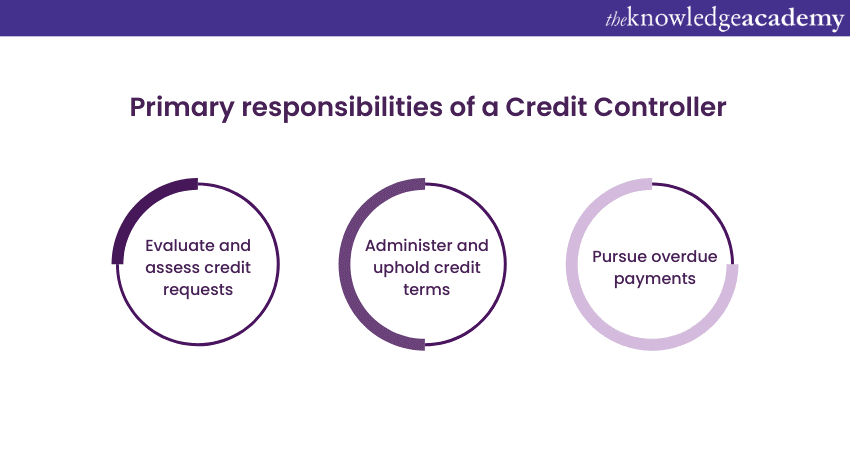

A Credit Controller is a person who is responsible for implementing and managing the Credit Control policy and strategy of a business. The primary responsibilities of a Credit Controller are:

Evaluate and assess credit requests

A Credit Controller has to evaluate and assess the credit requests from the customers or suppliers based on the credit standards and criteria of the business. A Credit Controller has to review the financial statements, credit reports, credit scores, references, guarantees, collateral, and other relevant information of the customers or suppliers and determine their creditworthiness and risk. A Credit Controller has to grant or deny credit requests and set the credit limits, credit periods, and credit terms for the customers or suppliers.

Administer and uphold credit terms

A Credit Controller has to administer and uphold the credit terms and conditions that have been agreed upon with the customers or suppliers. A Credit Controller has to send the invoices and reminders, make phone calls and visits, negotiate the payment plans, impose late fees and interest charges, withhold the deliveries or services, and take legal action, as per the collection policy and procedure of the business. A Credit Controller has to ensure that the customers or suppliers pay on time and in full and that the business receives the payments without any delay or dispute.

Pursue overdue payments

A Credit Controller has to pursue overdue payments from customers or suppliers who have failed to pay within the credit period or the agreed payment plan. A Credit Controller has to contact the customers or suppliers and find out the reasons for the non-payment or the late payment. A Credit Controller has to resolve the issues or problems that may have caused the non-payment or the late payment, such as the quality of the product or service, the delivery of the product or service, the invoice or the payment error, or the financial difficulty. A Credit Controller has to recover the overdue payments from the customers or suppliers and reduce the bad debts and write-offs of the business.

Unlock financial success with our Introduction to Credit Control Course – take control of your credit journey now!

Conclusion

We hope you’ve read and understood our blog on What is Credit Control. It is the linchpin in maintaining a balanced and sustainable business financial ecosystem. Credit Control is a vital business process focused on extending credit judiciously. It seeks to boost sales, minimise bad debt risks, optimise working capital, and nurture strong relationships with customers or suppliers. This multifaceted approach involves setting credit policies, assessing creditworthiness, enforcing payment deadlines, and managing overdue payments.

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 3rd Jan 2025

Fri 10th Jan 2025

Fri 17th Jan 2025

Fri 24th Jan 2025

Fri 7th Feb 2025

Fri 14th Feb 2025

Fri 21st Feb 2025

Fri 28th Feb 2025

Fri 7th Mar 2025

Fri 14th Mar 2025

Fri 21st Mar 2025

Fri 28th Mar 2025

Fri 4th Apr 2025

Fri 11th Apr 2025

Fri 2nd May 2025

Fri 9th May 2025

Fri 16th May 2025

Fri 23rd May 2025

Fri 6th Jun 2025

Fri 13th Jun 2025

Fri 20th Jun 2025

Fri 27th Jun 2025

Fri 4th Jul 2025

Fri 11th Jul 2025

Fri 18th Jul 2025

Fri 25th Jul 2025

Fri 8th Aug 2025

Fri 15th Aug 2025

Fri 22nd Aug 2025

Fri 29th Aug 2025

Fri 5th Sep 2025

Fri 12th Sep 2025

Fri 19th Sep 2025

Fri 26th Sep 2025

Fri 3rd Oct 2025

Fri 10th Oct 2025

Fri 17th Oct 2025

Fri 24th Oct 2025

Fri 7th Nov 2025

Fri 14th Nov 2025

Fri 21st Nov 2025

Fri 28th Nov 2025

Fri 5th Dec 2025

Fri 12th Dec 2025

Fri 19th Dec 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please